Market View May

Markets Recover Despite Fragile Sentiment and Trade Conflicts

created by Ullrich Fischer, Chief Investment Officer

-

Markets, Volatility & Productivit...Market View February 2026

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

- April was marked by historic volatility and a noticeable erosion of investor trust in US assets. The S&P 500 experienced a maximum drawdown of -20% since Trump’s Inauguration Day, making it the worst 100-day start to a presidential term since 1973. On the flip side, markets have mounted an impressive rebound from the lows. The Nasdaq-100 even closed April in positive territory.

- It seems the bond market effectively “broke” President Trump on 9 April, triggering a shift toward de-escalation in the trade dispute. The market has clearly set hard limits on the administration’s economic flexibility and room to negotiate. This perspective has since shaped our broader market outlook and expectation of more positive trade-related news.

- A strong market recovery, however, could also reignite Trump’s confidence and potentially lead to another round of volatility – where deals appear to unravel, only to be salvaged at the last minute. Overall, sentiment remains fragile and highly sensitive to the headlines, which continue to send conflicting signals around the US-China trade talks.

- US equity markets are near critical technical levels, with rare signals emerging that have historically indicated further gains. The sustainability of this rebound will hinge on the development of key macro data, notably related to the US labor market and inflation, and the reaction function of the US Federal Reserve (Fed) to these indicators.

- To gain greater confidence that the bottom is already in place, we would need to see the following: credible announcements that pave the way for a US-China tariff deal, a clear rebound in earnings estimates and a rising likelihood of more expansionary monetary policy in the second half of 2025. The next one to two months will be critical as the tariff-triggered supply shock will hit the US consumer.

Monthly Review

Policy shocks and echoes of 2020

- It has been an exceptionally volatile month, with sharp swings in both directions. As Steno Research also asserts, our view is that the current environment is a response to a man-made, external supply shock – similar to the Covid-19 pandemic, though smaller in scale. The stop-and-go dynamics are familiar: a policy shock disrupts the cycle, followed by a gradual unwinding. It is essentially a lockdown and then a reopening.

- If we are right in assuming the shock will now unwind in a measured and deliberate way, we could see patterns in inflation, interest rates and risk assets that recall the 2020 experience. More specifically, this could involve a sharp decline in the US ISM manufacturing index, also known as the purchasing managers’ index (PMI), through April and May, followed by a strong rebound into summer.

- Similarly, while US job openings remained stable for most of 2024, dipping around the election, they are now falling sharply. In this environment, significant net hiring seems improbable, and US non-farm payrolls (NFPs) are unlikely to exceed 100k per month. CNBC reports that 60% of CEOs expect a US recession in the next six months due to the tariffs.

- As a result, the Fed could face sluggish growth, weak net hiring and an administration that steadily eases tariffs. While an inflation spike into 2026 is possible as the business cycle reaccelerates, we believe a sharp year-over-year drop in inflation through April, May and June is more probable.

- This would once again mirror 2020, when inflation collapsed in the early months of the pandemic. Such a backdrop could ultimately give the Fed scope to ease policy more aggressively than the markets are currently pricing. But at the moment, the Fed is in a holding pattern and unlikely to take action before June or July, unless a market disruption occurs.

Market Development

World

- Over the next couple of months, we expect a steady flow of positive trade-negotiation headlines, culminating in a series of trade deals (or more accurately, given the US administration’s first 100 days, lightweight letters of intent). While these agreements may not significantly impact Main Street – the supposed focus of the Trump administration – they should help bolster market sentiment and partially restore CEO confidence.

- For now, we find it hard to envision the market setting new lows. Several factors support this view, such as the “Trump put” that revealed itself on 9 April and the stabilization of credit spreads. In addition, systematic equity selling appears largely exhausted, according to Deutsche Bank, with peak panic and uncertainty probably behind us. Taken together, these factors point to asymmetrical upside potential on any positive-leaning news flow.

- Earnings season, though still early, has kicked off more strongly than expected, and the blackout period for corporate buybacks is ending. We’ve already seen major buyback announcements, such as from Google. In addition, market breadth has sharply improved in recent days, which is historically a bullish signal. In our view, the pain trade would be a narrow rally led by artificial intelligence/Magnificent 7 stocks.

- When it comes to tariff negotiations, the projection of optimism from the US is notable. China is maintaining a more cautious and consistent wait-and-see stance, focusing on long-term strategy rather than short-term concessions.

- Looking beyond trade, geopolitical risks remain at their highest levels in decades. The latest flashpoint concerns the escalating tensions between India and Pakistan over Kashmir, with Pakistan warning of an imminent military incursion by India.

Europe

Weakening demand, rising unemployment and easing prices are creating a classic scenario for the loosening of monetary policy. Concerns about prolonged trade issues continue to drive money out of US equities, with all other regions seeing equity inflows during the week ending 23 April, according to Bank of America.

Switzerland

The Swiss franc has surged to a decade high against the US dollar, threatening Switzerland’s export economy and raising deflation risks. To counter this, the Swiss National Bank (SNB) may cut interest rates to zero or below, avoiding heavy market interventions to prevent being labeled a currency manipulator by the US. Diplomatic efforts are underway after recent US tariffs on Swiss goods, with markets expecting another rate cut by June with 80% probability.

The bond market has spoken, Trump has listened — but what would it take for the Fed to follow?

The bond market has emerged as a decisive force in shaping economic policy and market direction. We believe that bond market instability forced President Trump to blink on 9 April, triggering a shift toward de-escalation in the trade war – and revealing the administration’s limited room for maneuver. Today, the bond market remains a crucial barometer and is both a warning signal and a constraint on broader policy ambitions.

Although the topic is highly technical in nature, it’s important to explain how potential Fed intervention, triggered by bond market stress, could mark a positive inflection point for risk assets.

When Fed Governor Susan Collins stated on 11 April that the Fed was “absolutely ready to intervene to stabilize markets”, this raised a critical question: Why intervene during a sell-off driven by fiscal deficits and the erosion of trust in the US government? The deeper reason was likely mounting stress in the financial system.

Two major indicators pointed to this market dysfunction:

- First, the market-implied spread between the secured overnight financing rate (SOFR) and the federal funds rate (FFR) for June widened from 0 to 6 basis points within a few days. The SOFR reflects the cost of borrowing cash overnight using Treasuries as collateral, while the FFR is the interest rate at which the largest banks lend reserves to each other overnight. As these two rates tend to be closely aligned, a sudden divergence suggests funding market stress.

- The second indicator concerns the widening of the repo rates, which are critical for short-term borrowing in the financial system. Higher repo rates indicate that liquidity is drying up and financial institutions are becoming more cautious about lending cash against bond collateral – a negative signal for overall market stability.

This stress particularly affected a popular hedge fund strategy known as the swap spread trade. In this trade, investors go long (i.e. buy) 30-year US government bonds while simultaneously paying the fixed interest side in a 30-year interest rate swap. The goal is to profit from the difference between the bond yield and the swap rate, known as the swap spread. But during the recent sell-off, government bond yields rose much faster than the swap rates, causing the swap spread to widen aggressively within just a few sessions. This sharp move increased the cost and risk of holding leveraged positions, leading to a forced unwinding of such trades and exacerbating the bond market’s sell-off.

Underlying structural fragilities also made the situation worse. Government deficits and bond supply are on the rise, but the banks’ ability to absorb new government bonds has been weakened by post-2008 financial regulations restricting the percentage of bonds that banks can hold relative to their capital. As a result, hedge funds have increasingly become the marginal buyers of long-dated Treasuries. Hedge funds, however, are highly sensitive to market volatility. When volatility rises, they demand higher risk premiums to continue buying bonds. This dynamic creates a vicious cycle where lower demand leads to lower bond prices and even higher yields, further stressing financial markets.

Going forward, the Fed may well intervene should we see renewed dysfunction, such as a spike of 50 or more basis points in 30-year Treasury yields within a short timeframe. There are two primary ways the Fed could act:

- Standing Repo Facility (SRF): This tool provides temporary liquidity by allowing market participants to borrow cash against high-quality collateral like US Treasuries. It would address short-term funding pressures, similar to the Fed’s backstopping of markets during the Silicon Valley Bank crisis in 2023.

- Large-scale asset purchases (LSAPs): They could be required if the sell-off were driven by broader macroeconomic fears or a revolt by the so-called bond vigilantes worried about inflation and fiscal irresponsibility. Large-scale asset purchases (LSAPs) involve the Fed directly buying government bonds to stabilize prices and bring yields down. It is essentially quantitative easing (QE) under a different name.

The critical distinction between these interventions is that repo operations are a short-term technical fix for liquidity problems, while LSAPs represent a long-term commitment to altering the structure of bond yields. If the stress were purely technical – caused by the unwinding of leveraged trades like swap spread strategies – repo interventions would probably suffice. However, if the sell-off stemmed from deeper macroeconomic concerns, only a QE-style program would be capable of restoring confidence and stabilizing long-term interest rates.

Historically, such Fed interventions have marked liquidity turning points that tend to be supportive of equities, most recently in March 2020 and March 2023.

Positionierung

We selectively rebalanced equities in the panic phase of the sell-off following the US administration’s tariff announcements in early April. This brought our exposure back to neutral, with a bias to add selectively where individual stocks screen attractively. As Bank of America’s Michael Hartnett summed it up: “If there’s no recession, equity lows are in. But we can’t jump back into the bull camp unless Treasury yields drop below 4% and earnings growth stays above 5%.”

We are now entering a critical period as tariffs move from theoretical risk to real-world economic disruption. Container bookings from China to the US have collapsed by over 60% (Flexport), port activity is slowing and major retailers have started to warn of imminent shortages. These supply chain shocks are in effect mirroring Covid-era disruptions. If unresolved by summer, the initial first-order effects of shortages could lead to second-order consequences of rising costs, lost sales and layoffs that risk pushing the global economy closer to recession.

A technical recession in the US – rather than a recession as defined by the National Bureau of Economic Research – appears likely. Equities have already priced in a moderate growth slowdown, as reflected in recent downward earnings revisions, though have yet to fully account for a potential labor-cycle downturn. But there is little value in projecting beyond early summer, when the outcome of trade negotiations and tariff developments should be clearer.

This leaves the markets at a crossroads. The S&P 500 is testing key resistance in the 5,500–5,600 range. A decisive breakout would reinforce recovery prospects, potentially supported by strong Magnificent 7 earnings, improving technical breadth and more stable rates – as well as cleaner positioning, declining policy uncertainty and relaxed volatility (the VIX volatility index now tracks in the mid-20s).

However, if this rally merely proves to be a counter-trend bounce, weak liquidity and fragile sentiment could trigger a retest of recent lows. Assuming a true recession is avoided, we believe a 4,900–5,100 range on the S&P 500 offers attractive tactical entry points for medium-term positioning of 12 months and longer.

Meanwhile, gold’s 30% year-to-date rally to USD 3,500 per ounce underscores the deepening distrust in US fiscal and monetary policy. At the same time, the shift into higher-beta assets like Bitcoin signals an evolving risk appetite for such fiat debasement trades. Bitcoin, which is still under-owned by institutions, offers asymmetric upside, especially as a high conviction play on the anticipated dovish Fed policy in the second half of 2025. Bottom line: Until the outcome of trade negotiations is clear, we remain cautious with a slight optimistic bias. In our view, a durable improvement would require a policy reversal – a move that seems increasingly tied to President Trump’s approval ratings.

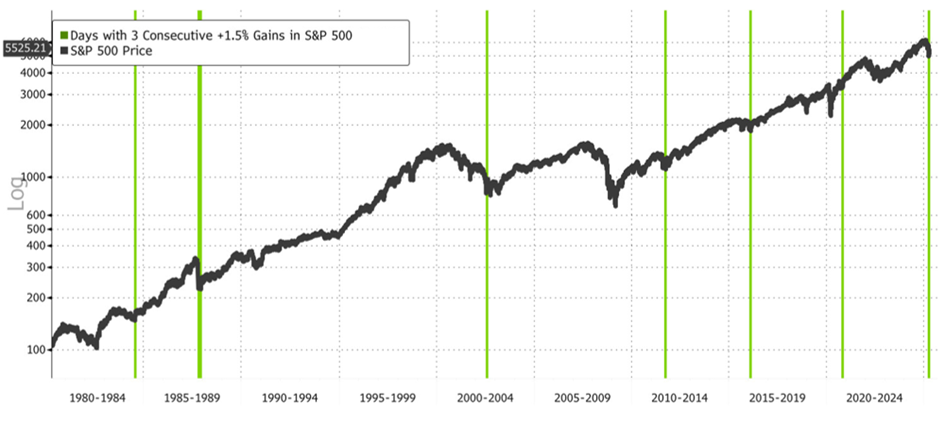

Three consecutive gains of +1.5% in the S&P 500 are a rare occurrence that historically tends to precede sustained bull markets

Source: Bloomberg

At least from a technical perspective, we are starting to see signals typically associated with a major market bottom. Historically, clusters of three consecutive +1.5% daily gains in the S&P 500 have often marked critical inflection points, usually preceding sustained bull runs. In technical terms, such strong consecutive gains reflect a surge in buying pressure and a sentiment shift from fear to optimism – key ingredients for durable market recoveries. Past examples include rallies after the 2000 dotcom bust, 2008 financial crisis and 2020 Covid recovery. The latest signals from 25 April indicate a potential pivot toward a new bullish cycle, provided we maintain supportive macro conditions such as stable earnings, moderating rates and a contained risk of recession. These fundamental factors are heavily contingent on the outcome of ongoing tariff negotiations.

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, LBBW, BCA Research

-

Markets, Volatility & Productivit...Market View February

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 29.04.2025.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.