Market View December

Positive momentum and US exceptionalism in a now late stage bull market

created by Ullrich Fischer, Chief Investment Officer

Executive Summary

- We maintain a tactically bullish outlook through the end of the year, underpinned by a favorable macroeconomic environment, robust US earnings growth and a risk-supportive Federal Reserve (Fed) stance. The post-election market momentum is expected to continue for the time being.

- Our tactical asset positioning emphasizes an overweight in equities, gold and alternative asset classes.

- Markets, in particular the fixed income markets, appreciated Scott Bessent’s nomination as US Treasury Secretary.

- US equities have significantly outperformed their European counterparts, driven by stronger GDP growth and substantial capital inflows. The S&P 500 has recorded its best 11-month stretch since 1997 and is on track for a rare consecutive 20%+ annual gain.

- In Europe, French bond yields recently spiked amid budget uncertainty. In Germany, an election looms in early 2025, with hopes rising that the outcome could potentially result in a more pro-growth policy agenda.

- US inflation has already stabilized above the Fed’s 2.0% target. This raises some concern about persistent price pressures and consequences for Fed policy as of mid-2025.

Monthly Review

US equities shine

- A strong November for US stocks: Last month, US equities delivered their third-best election-year gains in a century. While the rally fell short of the dramatic recovery seen in 2020, it has so far avoided overly exuberant sentiment as measured by the Bloomberg Intelligence Market Pulse Index. If the Fed maintains a dovish stance at the next Federal Open Market Committee (FOMC) meeting on 18 December, sentiment could further heat up and pave the way for a year-end rally.

- The likelihood of a rate cut of 25 basis points (bps) in the FOMC meeting, based on futures markets, once again surged to above ~70%. In addition to dovish signals from other Fed officials, Fed Governor Waller expressed support for returning to a neutral monetary policy from its currently tight stance.

- Sector rotation: The “Great Rotation” in US stocks continued, with cyclical stocks leading the gains. But we believe that the underperformance of value stocks relative to growth suggests that the market has yet to fully price in a potentially booming US economy.

- Fixed income and Fed developments: Bond yields retreated after Scott Bessent’s nomination as US Treasury Secretary, likely reflecting his past support of fiscal restraint.

Market Development

World

- S&P 500’s exceptional year: The index is on track for consecutive 20%+ annual gains – achieved only four times this century – despite elevated 22x price-to-earnings valuations, according to Deutsche Bank.

- The strong rally pushed up valuations, with the index trading past the decade average of 18x the projected 12-month forward earnings.

- US versus Europe: US stocks are trading at a 75-year high in relative terms compared with European equities. According to Bank of America (BofA), the last such outperformance was in 1976.

- The narrative around US “exceptionalism” this decade continues, with an average GDP growth of 2.3% (vs. 1% in Europe) resulting in a record USD 1.1 trillion inflow to US stocks (vs. a USD 0.3 trillion outflow from Europe).

- South Korea: The president’s declaration of martial law should not be seen as a further uptick in geopolitical risk. We believe it reflects desperate measures in a domestic policy standoff – and is one of many such global standoffs over budget negotiations.

Europe

- Uncertainty surrounding France’s budget has led bond investors to penalize France’s sovereign debt compared to its peers, pushing borrowing costs to levels aligned with those of Greece.

- In Germany, it remains to be seen whether the next federal government will be able to implement sufficient fiscal stimulus to revive the struggling economy. We believe that a possible suspension of the debt brake – now taken more seriously by market participants – would not derail the country’s robust public finances in the foreseeable future.

Switzerland

- The Swiss economy seems to be regaining momentum, as indicated by the November KOF Economic Barometer. After falling below the long-term average of 100 points in October – the first time since January – the leading indicator recovered last month.

Entering a late-stage bull market

We see supportive conditions for a year-end equity market rally that could continue into Q1 2025. Several factors contribute to this outlook:

- A bullish technical set-up: Equity market trends appear favorable and not overbought, providing room for further upside.

- Robust nominal growth in the US: Recession concerns have largely dissipated, and the fundamentals remain solid. The Atlanta Fed’s GDPNow model upgraded its Q4 2024 GDP growth estimate to 3.2%.

- US Treasury Secretary Janet Yellen supported the economy with significant monthly deficits to bolster strength before the election. This will likely be reflected in a strong Q4 GDP as well.

- A dovish US Federal Reserve: The Fed’s asymmetric dovish stance still prioritizes growth over inflation. The next FOMC meeting on 18 December will be critical, given hope for a 25-bps rate cut and liquidity-enhancing adjustments to balance sheet policy.

- US Treasury Secretary nomination: Wall Street considers Scott Bessent a pragmatic pick who has the right experience for the role. His nomination has been well-received by equity and bond markets.

- Improved sentiment and potential for “animal spirits”: Post-election consumer and business confidence indices have risen notably. Trump has shown a preference for rising stock prices as a validation of his policies, further supporting market optimism.

Looking ahead, the trajectory of asset markets hinges on the scale, timing and scope of President Trump’s economic agenda. Appointments such as Tom Homan as Border Czar, Jamieson Greer as US Trade Representative and Kevin Hassett as Director of the National Economic Council underscore the administration’s focus on stricter immigration enforcement and tariffs. In our view, this must be taken seriously.

The sequencing of fiscal policies could present challenges. Negative supply shocks from tariffs and immigration crackdowns could occur before the potential benefits of tax cuts, deregulation and accelerated energy production are felt. The markets’ ability to navigate these disruptions and focus on longer-term benefits will largely depend on domestic and global liquidity conditions in early 2025.

While the near-term liquidity outlook remains favorable, several risks – notably inflationary pressures – could disrupt this trend. We maintain a fundamentally optimistic view, though given the now late-stage bull market, we anticipate challenges from Q2 2025 onward.

The medium-term inflation outlook is concerning. Persistent inflation could constrain the Fed’s ability to cut rates beyond March 2025. Key inflation metrics – core consumer price index (CPI), personal consumption expenditures (PCE) and producer price index (PPI) – are now rising simultaneously for the first time since February 2022.

- Core PCE inflation: The Fed’s preferred gauge rose to 2.8% in October, up from 2.6% in July.

- Annualized PCE inflation trends: One-month PCE inflation is nearing 4% on an annualized basis, while the three-month rate is back above 2%.

- Core CPI inflation: This metric increased to 3.3% in October, marking the 42nd consecutive month above 3% –and the longest streak since the 1990s.

Positioning

We maintain a tactically bullish stance with an overweight position in equities and gold, and a near-full allocation to alternatives. The US “exceptionalism” narrative, which has been a key driver in recent years, is expected to persist into Q1 2025, though this narrative could peak in the first half of next year. The Nasdaq 100 is likely to outperform in the near-term, we think.

- We believe the “Magnificent 7” and AI stocks could perform strongly into the year-end if liquidity improves as we expect.

- The renowned NYU finance professor Aswath Damodaran recently emphasized these stocks’ ability to generate free cash flow: “As a value investor, I have never seen cash machines as lucrative as these companies are. And I don’t see the cash machine slowing down.”

- Their market capitalization of approximately USD 16 trillion exceeds that of the stock markets in Germany, Canada, the UK and France combined. Their immense size advantage acts as a liquidity magnet for passive investment flows into indexed products.

- JPMorgan strategist Dubravko Lakos-Bujas projects system-wide AI spending to exceed USD 1 trillion.

- US equities continue to benefit from an expanding business cycle, robust earnings growth, global central bank easing, and the anticipated end of the Fed’s quantitative tightening in early 2025.

The current investment environment heading into 2025 highlights economic divergence between the US and the rest of the world. Aggressive US growth and trade policies could exacerbate this decoupling. European sentiment in particular appears extremely negative, with valuations already reflecting this pessimism.

- In Q2 2025 we expect a hawkish Fed response to inflation and boom-like nominal GDP growth in the US, alongside policy challenges in Europe and Asia. A strong US dollar combined with weaker global markets could put pressure on US equities, given that close to a third of S&P 500 revenues come from overseas, according to BofA.

- European and emerging markets may present attractive opportunities by mid-2025. Factors such as Chinese fiscal easing, European fiscal stimulus and European Central Bank rate cuts could drive investor interest in undervalued international assets.

In our view, a disorderly rise in bond yields, fiscal concerns and geopolitical instability remain the most significant risks to equities.

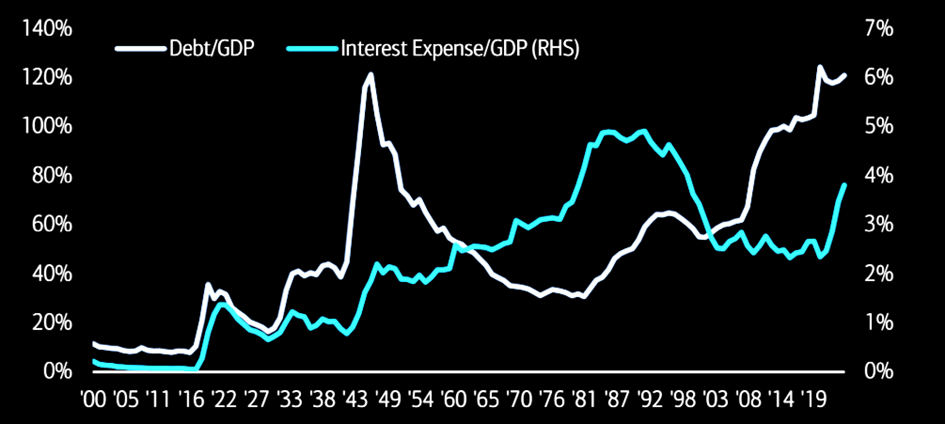

US debt levels to reach uncharted territory

Source: Bank of America

The cost of servicing the US debt could put increased pressure on the Fed to ultimately monetize (i.e. buy) more of it to keep the real interest cost from weighing on growth and curtailing Trump’s aims. In our view, this would be a clear tailwind for real assets. We expect gold, crypto and commodities to perform well if this unfolds.

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, LBBW, BCA Research

Disclaimer

This Publication was created on 04.12.2024.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.