Market View February

Markets, Volatility & Productivity Disruption

created by Ullrich Fischer, Chief Investment Officer

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

Macro: Global growth remains resilient despite elevated volatility and rising dispersion across asset classes. U.S. data continue to surprise to the upside, reinforcing a “run-it-hot” growth narrative supported by strong productivity momentum. In contrast, Europe still shows limited cyclical traction.

Markets: Markets are characterized by sharp rotations rather than broad risk-off behavior. Emerging markets and Value have outperformed, while U.S. Growth—particularly software—has come under pressure amid concerns over AI-driven disruption. Commodity volatility has surged, with precious metals experiencing extreme moves, reflecting rising uncertainty around monetary policy.

Monetary Policy: The policy backdrop remains broadly accommodative. We view Kevin Warsh’s nomination as an effort to re-anchor central bank credibility by emphasizing balance-sheet discipline while leaning on productivity-driven disinflation to justify lower interest rates. We expect a dovish bias in practice, with limited scope for aggressive quantitative tightening. However, the range of possible outcomes has widened.

Outlook: AI-led productivity gains remain a structural tailwind, though unevenly distributed across sectors. Equities retain upside despite higher volatility, commodities remain attractive strategically, and gold is likely to consolidate after a necessary washout has reset positioning. Overall, the macro backdrop continues to support risk assets in our view.

Monthly Review

Year-to-date performance has been marked by sharp swings and extreme dispersion across asset classes. It has been instructive to see which early-year themes have proven resilient and which are starting to falter. Precious metals are showing renewed signs of strength, with gold recovering more than half of last week’s decline, while Bitcoin remains notably under pressure.

Markets have entered a phase of pronounced but uneven volatility, with sharp dislocations in select areas while high dispersion between winners and losers has kept headline equity indices relatively stable.

Overall, we do not see evidence of a broad capitulation in crowded trades; rather, the pullback has been selective, with software equities and crypto assets standing out as the main areas of stress.

- Emerging markets have surged, U.S. technology has lagged, and commodities have experienced outsized volatility.

- Emerging market equities are the clear standout, with the MSCI EM Index up 9.4% YTD—its strongest start since 2012 and a decisive reversal after years of underperformance.

- Style leadership has flipped: Value is up while Growth is down, with a performance spread of roughly 7 percentage points, ranking among the most extreme monthly rotations on record.

- Sector dispersion is also elevated, with an approx. 17 percentage-point gap between Materials and Communication Services, placing it in the 95th percentile historically.

- Commodity volatility has been the most visible expression of this market instability. Gold’s 30-day volatility jumped from around 20% in early January to over 46% by early February, its most volatile period since the global financial crisis.

- Silver has been even more extreme, with volatility reaching triple-digit levels last seen in 1980, including a near-unprecedented 31% single-day collapse before rebounding.

- From a macro perspective, the latest ISM release reinforces the “run-it-hot” narrative: the headline index rose to its strongest level since August 2022, new orders reached their highest since February 2022, and employment improved—underscoring our view that consensus remains overly pessimistic on U.S. growth.

Productivity Disruption

We have argued for some time that productivity is set to accelerate meaningfully, driven by rapid advances in artificial intelligence. For markets, it seems, the key question now is no longer whether productivity will rise, but how unevenly its gains—and disruptions—will be distributed.

Recent equity stress has been concentrated in the software sector. Sharp declines in several large names have triggered what traders have dubbed a “SaaSpocalypse,” in essence broad and largely indiscriminate selling across software-as-a-service (SaaS) stocks. JPMorgan points to Anthropic’s rapid evolution of Claude—from a large language model into an agentic, task-executing platform—as a key catalyst, heightening fears that AI is shifting from a productivity enhancer to a direct substitute for knowledge-based, white-collar labor.

At the core of the selloff is the concern that generative AI threatens traditional software economics: seat-based pricing, predictable recurring revenues, and incumbent moats. Investors are increasingly focused on the risk of declining user counts, margin compression, and forced pricing resets as AI-native competitors with leaner cost structures emerge. Scale and incumbency are no longer rewarded by default; barriers to entry are weakening, and pricing power is being questioned—to some extent, fairly so, in our view. That said, markets appear to be extrapolating the pace and scope of AI-driven change in ways that – to us – seem excessive. Sector valuations are now approaching the 2022 and Covid lows.

There is also a strong counter-narrative. By sharply reducing the cost and time required to build software, AI should fuel an explosion in code and applications, generating more data—not less—and supporting rising demand across the infrastructure stack, from databases and storage to security, governance, and observability. Moreover, it seems unlikely that enterprises will completely abandon mission-critical vendors in favor of fully internal, AI-native solutions.

As Nvidia CEO Jensen Huang noted this week, “The notion that AI is somehow going to replace software companies is the most illogical thing in the world.”

We are strong believers in the productivity revolution and remain cautious about the software trade even as valuations look outright cheap.

AI represents a structural tailwind for select data-infrastructure segments, while elements of the traditional enterprise software model appear structurally challenged. This looks less like a cyclical slowdown and more like a regime change. Even so, markets seem to be overreaching by penalizing the entire sector indiscriminately.

Europe

The ECB’s quarterly Bank Lending Survey points to continued caution among banks in lending activity and a further tightening of credit conditions. While demand for corporate loans increased slightly, the real estate segment saw a pronounced slowdown. Overall, the results are underwhelming and suggest little prospect of a meaningful credit impulse for the euro area at present.

Switzerland

Swiss equities have recently outperformed European peers and reached record highs, driven by strong gains in defensive heavyweights such as Nestlé, Roche, and Novartis. The move reflects a flight into defensives amid rising market uncertainty, particularly around potential AI losers.

Kevin Warsh – the new Fed Chair

Kevin Warsh’s nomination is being interpreted by markets as a potential inflection point for U.S. monetary policy at a time when credibility, inflation tolerance, and dollar stability have become central concerns. Unlike more conventional candidates, Warsh brings a clearly articulated framework, experience across markets and policymaking, and a long-standing skepticism of central-bank overreach. Whether that framework can be fully implemented is uncertain—but the narrative itself already matters.

Warsh’s background helps explain both his appeal and the controversy surrounding him. He served as a Federal Reserve governor during the financial crisis, where he became a key conduit between Wall Street and policymakers, drawing on earlier experience at Morgan Stanley. After leaving the Fed, he worked closely with Stanley Druckenmiller—one of the most influential macro investors of the past several decades—as did current Treasury Secretary Scott Bessent. That shared lineage anchors both men in a market-aware, balance-sheet-centric view of macro policy rather than a purely academic one.

Druckenmiller has been explicit in Warsh’s support: “He’s been in markets, he’s been in the Fed, and he’s not going to be stupid enough to do QT [Quantitative Tightening] and cause an economic meltdown”. He has also emphasized that Warsh is “very open-minded” to the Alan Greenspan-era framework, in which productivity growth does much of the inflation-fighting work. Warsh, in Druckenmiller’s words, believes “you can have growth without inflation,” and he has praised the alignment between Warsh and Bessent—both his former protégés. It is hard to overstate Druckenmiller’s exceptional track record and ability to read the market, so we take his comments very seriously.

At the core of Warsh’s thinking is a supply-side argument about near-term Fed policy: an AI-led productivity boom can allow interest rates to fall without reigniting inflation. In this framework, productivity-driven disinflation offsets easier financial conditions, reducing the need to keep rates restrictive simply because growth remains strong. Growth itself is not treated as inflationary if it reflects genuine productivity gains rather than excess demand.

This logic extends to how Warsh thinks about monetary strategy more broadly. He has argued that the Fed should be less mechanically data-dependent, given how frequently economic data are revised, lagging, and distorted in real time. He is openly critical of forward guidance, dot plots, and published economic forecasts, believing they create false precision and unnecessarily constrain policymaking. In Warsh’s ideal framework, uncertainty is a feature, not a bug: markets should price risk rather than rely on central-bank signaling.

The Fed balance sheet plays a central role in this worldview. Warsh favors banking deregulation and a reorientation of credit creation away from the Fed’s balance sheet and toward the private sector—specifically a more decentralized banking system built around small and mid-sized banks rather than a handful of dominant institutions. In his ideal world, the Fed shrinks, reserves decline, and liquidity creation migrates back into a competitive, regulated banking sector rather than remaining concentrated in large banks, private credit funds, or the central bank itself.

In practice, however, we think commentators are rightfully skeptical that a meaningful additional balance-sheet reduction is achievable. Convincing a 12-member FOMC—many of whom are deeply concerned about market stability—to pursue aggressive QT will be extremely difficult. Political incentives also point in the opposite direction: President Trump wants lower rates and strong asset markets, not prolonged liquidity withdrawal.

Warsh’s challenge is, therefore, not whether to be dovish, but how to justify dovishness while preserving credibility. His framework seems coherent—leaning on AI-driven productivity gains and balance-sheet discipline to argue that lower rates need not be inflationary. If successful, this could help anchor long-end yields and limit excessive dollar weakness, albeit at the cost of higher uncertainty and volatility—an acceptable trade-off given still-solid macro fundamentals and corporate earnings.

That said, much remains provisional: we have yet to hear directly from Warsh, and the next one to two months will be critical. His nomination could mark a hawkish shift in the policy reaction function, but it is not our base case.

Positioning

We believe market commentators are too quick to label Kevin Warsh an inflation hawk based on views he expressed more than a decade ago. Political reality matters: President Trump would not nominate a Fed chair unwilling, in practice, to ease policy.

We thus expect the policy bias to remain dovish as long as inflation remains contained. Meaningful quantitative tightening is unlikely, constrained by FOMC consensus, market-functionality risks, and political realities.

Our working thesis implies a flat-to-weaker dollar, higher equities, and a tendency toward curve steepening. Should long-end yields become disorderly, adjustments in Treasury issuance under Scott Bessent would likely act as stabilizers.

Bottom line: markets are nervous but global fiscal spending keeps economies running hot, the Fed remains accommodative, and equities and commodities retain upside convexity. The recent parabolic move and pullback in precious metals may point to a late-stage debasement trade, but there are no broad signs of stress: rates are stable, risk assets resilient in aggregate, and capital flight absent.

Equities: Over the medium term, productivity-driven growth should continue to support equity markets, even if the path is choppier. We still view AI adopters—particularly large non-tech firms—as the key winners.

Gold: Gold’s surge reflects skepticism about the long-term policy endgame rather than near-term inflation. Warsh’s nomination appears aimed at backstopping this trust erosion. We view the recent volatility as a necessary washout rather than a definitive peak, though risks for the debasement trade have risen.

USD: Warsh’s nomination removes the worst-case dollar scenario. We now expect a moderate, controlled depreciation rather than a disorderly decline.

Commodities: We view commodities as attractive strategic allocations and key beneficiaries of a renewed growth upswing, particularly industrial metals.

Bitcoin: We are surprised by the massive divergence between gold and bitcoin as we had expected Bitcoin to be a debasement winner. Instead, Bitcoin and other crypto assets have fallen in a bear market that looks to continue for some time, if history is any guide. Potential catalysts for a turnaround are new U.S. crypto legislation, institutional adoption of stablecoins and tokenization of assets, as well as implementation of a U.S. strategic bitcoin reserve. We keep our portfolio allocation unchanged and might increase it if prices drop significantly further.

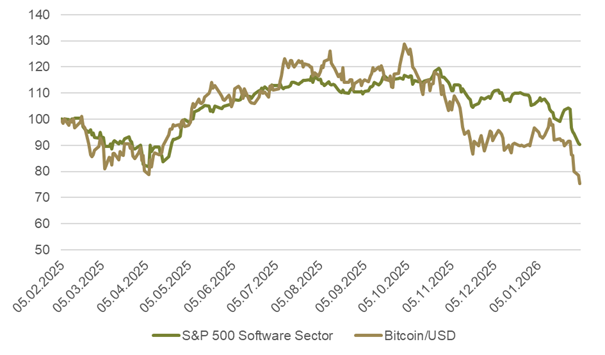

Software and Bitcoin – Shared Pain

Source: Bloomberg

Bitcoin has fallen sharply to about 70’000 USD, erasing its gains since Trump’s election in 2024. The drawdown in price from its peak in October 2025 amounts to 45% already. Interestingly, Bitcoin is falling in tandem with software stocks. Many investors seem to falsely commingle Bitcoin with Software, even if Bitcoin is not at risk of Artificial Intelligence.

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, BCA Research, Renaissance Macro, BlackRock, 3Fourteen Research, TS Lombard, Ned Davis Research, Vontobel

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 05.02.2026.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.