Market View November

The AI Supercycle, Fed Easing & a Steady Year-End Rally

created by Ullrich Fischer, Chief Investment Officer

-

Markets, Volatility & Productivit...Market View February 2026

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

Macro backdrop: Presidents Trump and Xi extended the US–China tariff truce for a year, canceling planned 100% US-tariffs and postponing rare-earth export controls. The US government shutdown has created a fog of missing data, but equities remain unfazed, with markets accurately pricing a trade agreement in advance and reaching new all-time highs.

Markets: AI remains the dominant driver. While a CapEx bubble could form eventually, there aren’t too many late-cycle signs yet. We stay constructive but remain on “bubble watch” for 2026.

Monetary policy: The Fed cut rates by 25 bps for a second consecutive meeting. Chair Powell struck a hawkish tone, suggesting a potential pause in December. On the other hand, the Fed accelerated the end of QT, easing liquidity pressures. Softer CPI helped.

Earnings: The Q3 US earnings season is progressing strongly, with an 80%+ beat rate (compared to the 30-year average of 67% and a prior four-quarter average of 77%). Tech leads again – Apple, Alphabet, Microsoft, and Amazon delivered strong results despite elevated AI CapEx.

Outlook: Fed easing, resilient earnings, and improving US–China relations support a steady year-end rally where liquidity remains the key driver. Historically, Fed cuts at record highs have preceded further gains in equities over the coming year.

Monthly Review

- At a landmark summit in Busan, Presidents Trump and Xi extended the US–China tariff truce for a year and eased trade frictions:

- Trump’s threatened 100% tariff hike was canceled

- China paused rare-earth export controls and will resume large US farm imports

- The US rolled back restrictions on Chinese firms and halved fentanyl-related tariffs to 10%, lowering the effective tariff rate on Chinese goods to ~47%

- Both sides pledged to resolve the TikTok ownership issue

- Reciprocal visits were confirmed for 2026 (Trump to China, Xi to the US)

- Soft inflation data (still at ~3% year-over-year but not accelerating) gave the Fed cover to cut rates for the second consecutive meeting to address a weakening labor market. The 25 bps reduction came with a hawkish tone – Chair Powell noted “strongly differing views” within the FOMC and cautioned that a December cut is “not a foregone conclusion”. Market-priced December cut odds lowered in response, to around 65% from 90%+ before the recent Fed meeting.

- Powell: “What do you do when you’re driving in fog? You slow down.” – this may hint that Powell would prefer keeping rates unchanged in December.

- We think it will ultimately depend on the macro data – assuming the US government shutdown ends in time to bring in new releases. At least one more cut in December or January remains our base case – to conclude the series of “risk management cuts” Powell started in September – before a broader reassessment of macro conditions.

- The Fed also pulled forward its plan to end quantitative tightening, which should ease recent liquidity pressures in funding markets.

Market Development – AI Adoption & Infrastructure

World

AI adoption is advancing at the fastest pace in history – building on the foundations of the internet and smartphones and scaling at a rate unprecedented even by technology’s own standards. The real competition today centers on capturing power and users, fueling an intense arms race between OpenAI and its peers.

A useful parallel may be Facebook’s (now Meta) 2012 IPO, when many doubted its ability to monetize. Since then, the stock has risen nearly twentyfold, demonstrating that once adoption reaches billions in users, the ability to monetize naturally follows. For now, the AI race is primarily about users and computing power, not yet about revenue.

- US dominance: The US hosts 5,400+ data centers, more than all other major economies combined, with USD 40 bn in new projects currently under construction (+400% since 2022). Data centers are expected to surpass office buildings in total value, with energy demand projected to reach 8.1% of US power use by 2030 (vs. 3.9% in 2023).

- China: Operates fewer data centers (~450) but at a larger average scale.

- Power costs: US electricity prices have climbed +23% since ChatGPT’s launch in Nov 2022 and +40% since 2020.

- Alphabet: Surpassed earnings and revenue forecasts, achieving a record USD 100 bn in quarterly revenue. Google Cloud grew 34%, backed by a USD 155 bn backlog and AI adoption among 70%+ of clients.

- Microsoft: Beat estimates despite a USD 3 bn OpenAI-related charge. Azure cloud service revenue jumped 40% on AI demand, though higher capital spending moderated investor enthusiasm.

- Amazon: Amazon Web Services reported USD 33 bn in revenue, up 20% year over year, the fastest growth since late 2022. CEO Andy Jassy cited strong momentum and emphasized AI’s growing role across AWS operations.

Europe

Euro-area GDP data painted a mixed picture: Spain and Italy underperformed, while France and Germany exceeded expectations, lifting overall growth to 1.3% year-over-year (vs. consensus +1.2%). Despite the modest upside surprise, momentum remains weak amid subdued retail activity and sluggish industrial output. Tariffs and a stronger euro continue to weigh on competitiveness, while rising import pressure from China adds further strain. Germany remains the slowest-growing major economy, and with structural reforms still lacking, hopes for meaningful fiscal stimulus have faded, constraining the region’s recovery prospects.

Switzerland

Switzerland’s KOF index rose unexpectedly in October, but the earlier May peak still signals fading momentum. The strong franc is straining exports and complicating SNB policy. Tariff-related US import front-loading has distorted recent data, making some months appear stronger than underlying trends. As this reverses, activity should soften further. With the franc’s strength reinforcing deflation risks, the SNB faces a dilemma: either penalize franc holdings with negative interest rates or step up FX interventions to stem safe-haven inflows – potentially endangering a trade agreement with the US.

The AI Super-Cycle: Strong Momentum, Fading Macro Risks, but Bubble Watch On

While investor attention remains split on the Fed, data, and trade policy, the dominant market driver is artificial intelligence.

AI investment may ultimately evolve into a CapEx bubble, but that is no reason to turn bearish now. There is little evidence that we are in the late stages of such a cycle at the moment. While every past major tech buildout eventually led to overcapacity, our current view is that a sizeable correction is at least several quarters away, with no clear catalyst for an imminent reversal.

That said, we remain on “bubble watch” and ready to adjust our view quickly if conditions change. To that end, we are developing ways to monitor secondary-market and rental prices for GPUs as a gauge of the evolving supply–demand dynamics in the AI buildout.

We are now entering the seasonally strongest period for equities. With the Federal Reserve and a large portion of corporate earnings behind us, markets are transitioning into the year-end phase where investors tend to reinforce prevailing winners to enhance returns or improve portfolio optics.

That momentum is supported by several factors:

- Recession risks remain low – at least based on alternative data available during the government shutdown, which suggests robust economic growth in Q3 and early Q4.

- Monetary and fiscal policies are accommodative

- Investor sentiment remains skeptical and discretionary investors are underpositioned

- President Trump is booking trade agreements across Asia

- Generally strong corporate earnings results

- Political uncertainty has fallen (but remains elevated in historic comparison)

In our view, the bearish case remains unconvincing:

- Valuations: Equity market valuations are indeed elevated, but valuations alone are not a timing tool. Without a clear catalyst, high multiples are a reason for caution, not reduction.

- Market breadth: True, the rally is concentrated in AI-related names. But in this bull market we have often observed that AI leads to new highs and then consolidates while the rest of the market catches up. The MSCI World equal weight has also made new highs this week, so breadth is not as bad as perceived.

- US Government shutdown concerns: While the economic cost will eventually surface, the impact will take months to appear in hard data. Political pressure to resolve the issue may ultimately become another supportive factor.

- Perceived Fed hawkishness: Market pricing for a December rate cut has moderated. With the communication blackout now over, more dovish FOMC members (promoting themselves as possible new Fed Chairs) are likely to temper Chair Powell’s hawkish tone.

In summary, the AI-driven rally remains the central market narrative, and for now, there is little evidence to justify stepping aside.

Key Supreme Court Date for Trump’s IEEPA Tariffs on Nov 5th

Many may be overlooking a crucial event: on Nov 5, the US Supreme Court will weigh in on the constitutionality of Trump’s IEEPA tariffs. (IEEPA stands for the International Emergency Economic Powers Act — a US federal law enacted in 1977.) The court will decide if IEEPA – designed for national-security emergencies – can justify tariffs tied to economic issues like trade deficits.

If struck down, 55% of US tariff income (~USD 150–200bn annually) would vanish from the 2026 budget, and US firms could claim refunds for 2025 payments — a de facto USD 200bn fiscal stimulus – on the other hand, potentially a problem for the deficit and bond markets? Even if overturned, Trump could re-impose tariffs through alternative legal channels.

- Tariffs function like a corporate tax, reducing US margins. Removing them could meaningfully boost profits and demand.

- Wall Street banks (Jefferies, Oppenheimer) are currently structuring trades for hedge funds to buy tariff-refund claims from importers, that would pay if tariffs are struck down. Pricing of these trades currently imply 30–40% odds the tariffs are overturned – not the base case but a significant enough chance to take note.

- If Trump loses, he could still re-impose tariffs via Section 232 (national security), Section 301 (trade retaliation), or Section 122 (temporary emergency tariffs) – or seek Congressional approval, which is unlikely as the Senate voted three times this week against tariffs on Canada, Brazil and global tariffs (4 Republican senators joined Democrats).

Positioning

We maintain our bullish outlook into year end. Risk assets can rise sharply after sell-offs or grind higher during calm periods. The current environment favors the latter – a steady year-end climb as risk premia compress. With low volatility, strong liquidity, and fading uncertainty, markets are likely to continue their gradual ascent along the “wall of worry”.

Key tactical drivers:

- US corporate buybacks resuming

- US–China tensions easing

- Limited economic data flow from the shutdown curbing volatility

- Fed policy outlook stable, with another cut likely within three months. Historically, Fed cuts with the S&P 500 at record highs led to sizeable gains over the coming year

Looking into 2026:

The debate around the new Fed chair will heat up towards year-end and into Q1. Markets typically test new Fed chairs with an average 15% equity correction in the first six months of his term according to Ned Davis Research.

Fed independence will face renewed scrutiny but with about half a year before Hassett, Waller, Warsh, Bowman, Rieder—or Bessent—takes office, investors are likely to remain focused on a friendly Fed, at least until January.

Bull markets usually end when the Fed withdraws liquidity. For now, the opposite is true: the Fed is cutting rates and pausing QT. Liquidity – not valuation – remains the driver for the time being. While a too-dovish new chair could unsettle inflation expectations and bond markets in 2026, this risk is not yet relevant for markets. The “pain trade” still points up.

Emerging Markets Equity: The MSCI EM Index is on track for its tenth consecutive monthly gain, up 44% in USD total return terms since April lows. The renewed US-China truce lifts Asian exporters, while AI momentum supports EM chipmakers and component suppliers. Valuations remain attractive, offering cheaper AI exposure than developed markets. We added to our EM positions in October.

Credit: Recent pockets of credit stress – mostly related to private credit – appear idiosyncratic rather than systemic, and neither the economic backdrop nor current policy settings indicate an imminent break in the credit cycle. Nevertheless, tight spreads, the rapid growth of opaque private debt and years of ultra-loose monetary policy, argue for caution. We remain broadly underweight fixed income and continue to favor short-duration corporate bonds over sovereigns. We expect more modest returns and a less attractive risk-reward profile in credit compared with prior years.

Gold: After gold’s sharp two-month parabolic rally began to show signs of fatigue, we took partial profits in October but continue to maintain an overweight position. The long-term bull case – supported by central bank demand, fiat currency debasement, and gold’s growing appeal as a superior portfolio diversifier – remains firmly intact. Corrections of 10–15% have been typical in previous bull markets. We would look to add back exposure on any downside overshoot.

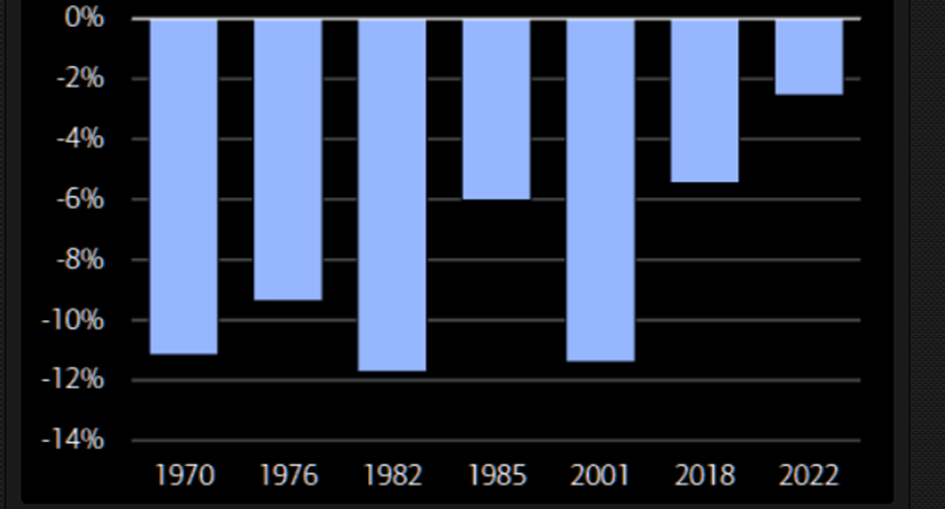

Gold price month-over-month declines in prior bull markets (in USD)

The current –11% drawdown remains well within the historical range for gold bull markets since 1970, which have averaged declines of around 13% during uptrends, according to 3Fourteen Research. On a monthly basis, drops of 10% or more have also been common in past cycles and were typically followed by strong rebounds. Still, the recent spike in volatility will likely take time to subside, suggesting that price action may remain choppy before stability returns.

Source: Bank of America, 3Fourteen Research

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, BCA Research, Renaissance Macro, BlackRock, 3Fourteen Research, TS Lombard, Ned Davis Research

-

Markets, Volatility & Productivit...Market View February

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 31.10.2025.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.