Market View October

Skepticism Fuels the Bull: Under-Owned Rally Has Room to Run

created by Ullrich Fischer, Chief Investment Officer

-

Markets, Volatility & Productivit...Market View February 2026

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

- Markets: Global equities rallied in September despite fears of weak seasonality, driven by the first US rate cut since December 2024 and broad-based gains.

- Macro backdrop: “Goldilocks” conditions persist – record highs in equities, corporate earnings, and gold, while US 10-year yields stay below the 4.5% risk threshold. US labor softness so far is concentrated in low-wage sectors. Household demand remains solid, and GDP growth is tracking 3–4% in Q3.

- Monetary policy: Markets price two more Fed rate cuts this year. Easing into a mostly solid economy underpins the bullish narrative. Data delays caused by the US government shutdown could support the Fed’s dovish tilt as the FOMC will be anchored on labor market weakness of prior data releases.

- AI capex: AI spending outpaces consumer-driven GDP growth in the US. The investment spree resembles prior booms, with debt-financed deals (e.g., Oracle’s $60B OpenAI pact) raising concerns over excess – though current tech leaders remain cash-rich and profitable. Earnings quality does not point to a bubble for now, however, this could change in 2026.

- Outlook: Despite strong equity markets, investor skepticism persists. With fiscal support, corporate capex, dovish monetary policy, and moderate sentiment, the rally looks under-owned rather than exhausted. We remain positioned for persistent risk-on markets, driven by an environment of fiat debasement and financial repression, and plan to add on dips.

Monthly Review

- Global equities rallied in September despite seasonality concerns, boosted by the first US rate cut since December 2024 and broad-based market gains.

- Equity markets, S&P 500 earnings, and gold have all reached record highs. At the same time, the 10-year Treasury yield has risen 10 bps to 4.1% since the Fed’s September rate cut – yet remains well below what we view as the critical 4.5% threshold. Bottom line for us, this remains a “Goldilocks” market.

- Labor data remain mixed, but much softness stems from supply frictions rather than collapsing demand. The Fed is leaning toward “insurance” cuts; Powell stressed policy is still restrictive, and markets now price two more cuts in October and December.

- The Atlanta Fed’s Q3 GDP Nowcast is running at 3–4%, despite worries about the labor market. Since labor market weakness is mostly present in low-wage sectors, overall demand from households remains solid. In addition, AI-driven capital spending has become a major growth engine. In the first half of 2025, it contributed more to US GDP growth than consumer spending.

- AI infrastructure is expanding rapidly: data center construction now surpasses office buildings in the US, straining power grids and driving up electricity costs. The “Magnificent 7” lead this wave, with AI powering ~75% of S&P returns, 80% of earnings growth, and 90% of capex growth since late 2022 (JPMorgan). Oracle’s $60B annual OpenAI deal, funded by debt, may signal a shift from cash-flow-driven hyperscaler spending to a debt-fueled arms race.

Market Development – Data delays caused by the US government shutdown could spur Fed easing

World

The US federal government shut down this week after Congress failed to agree on funding, with Republicans and Democrats divided over enhanced Affordable Care Act (“Obamacare”) subsidies.

We believe the shutdown is unlikely to have a material impact on equities. The fiscal effect is limited because mandatory spending, such as benefits and interest payments, as well as tax collection, continue. The disruption may also prove short-lived, as Republicans appear open to extending some Affordable Care Act subsidies – the main Democratic demand. In addition, there is no parallel debt ceiling standoff, since that issue has already been resolved through the reconciliation process.

Several key economic data releases will be delayed, including jobless claims, employment reports, trade balance, retail sales, and CPI/PPI inflation. Ironically, in the absence of new data, the Fed should be inclined to act more dovishly to stabilize the deteriorating labor market. The shutdown has increased the odds of an interest rate cut in October.

Historically, most US shutdowns have been brief; only four have lasted more than two weeks. A 30-day shutdown would have an economic impact comparable to five months of tariffs, but these effects typically reverse once the government reopens. Markets expect a quick resolution – Polymarket currently shows a 55% probability the shutdown ends before October 15.

Europe

In Copenhagen EU leaders met this week for a major summit focused on drone defense. The centerpiece was a proposed “Drone Wall” along Eastern Europe to detect and neutralize Russian drones. Beyond that, NATO sentiment has improved. President Trump has pledged continued US arms for Ukraine, provided Europe pays. While Europe pushes for more defense independence, US systems remain indispensable. There could be growing potential for US defense stocks to benefit and catch up to European peers.

Switzerland

Swiss inflation remained unexpectedly low in September, rising just 0.2% y/y – unchanged from August and below most forecasts. This complicates the SNB’s task as the economy also faces pressure from US tariffs.

Rate cuts so far have failed to weaken the franc, which is now stronger than before easing began. The SNB resumed FX intervention in Q2 after a 15-month pause, buying CHF 5.1bn in foreign currency. With safe-haven demand elevated and disinflation risks mounting, further interventions and even negative rates remain clearly on the table, in our view.

Could this un-loved bull market turn into a bubble before it ends?

The S&P 500’s rally is already historic. It ranks as the fourth strongest bull run on record (behind 1982, 2009, and 2020), and the strongest recovery outside of recessions. In number of days without a 6% pullback, it has already surpassed all but two early-stage bulls (1957, 1966), according to 3FourteenResearch.

From a fundamental perspective we are firmly in a bull market. Momentum, positive earnings revisions, and improving breadth suggest durability. The upcoming Q3 earnings season may top the 7% growth currently expected, as has happened in recent quarters. Morgan Stanley notes that median stock EPS growth – negative through much of 2022–2024 – has flipped positive at +6%.

Additionally, equity returns are once again positively correlated with inflation breakevens, a hallmark of early-cycle recoveries. Likewise, cyclicals are outperforming defensives, breaking the downtrend from April. Yet full rotation into lower-quality stocks has been limited. The Fed’s delay in cutting rates has restrained this move compared to prior cycles. The market wants the Fed to act faster. Fiscal imbalances mean eventually the Fed may have to let inflation “run hot” for a while to ease the debt burden.

1. The economy could look weaker than it really is

According to Steno Research, labor market reports may exaggerate weakness. Migration reversals distort payroll data: many migrants hold multiple part-time jobs, so when they leave, losses are effectively double-counted. Meanwhile, the “birth-death” model for business formation amplifies volatility.

The birth–death model is a statistical adjustment the BLS uses to estimate jobs created by new businesses (“births”) and lost when firms close (“deaths”), since these aren’t captured in real time. In a typical month it can account for ~20–50% of the headline payroll change(and occasionally more when the sample-based estimate is soft). Problematically, the model relies on historical patterns, not current data, so during turning points it often overstates gains in booms and exaggerates losses in downturns. Poor data quality, as highlighted by many research houses, could make the data appear worse than the actual underlying conditions. In per-capita terms, the economy is healthier than headlines suggest, though the official numbers will keep flashing red until these quirks wash out.

2. The Fed has cover to cut

Even if the labor market isn’t collapsing, the weak readings of recent months give the Fed political cover to ease into what is still an “OK” economy.

3. Trumponomics = Debasement

Fiscal expansion is dominating monetary easing into outright debasement. Beyond near-term noise, structural forces, such as reshoring and automation, will continue to reshape growth and inflation.

Key questions in this environment: How mature is this bull market, and could the AI hype lead to a melt-up? Could a more dovish Fed – especially under a new Fed chair – and rising fiscal dominance steer the economy even more into financial repression, and what would that mean for inflation, bond yields, and the US dollar?

Former Fed Chair Bill Martin once said it was the Fed’s job “to take away the punch bowl just as the party gets going.” Today, the opposite seems true, as multiple forces add liquidity and increase risk appetite:

- Government spending – At 6.5% of GDP, the US deficit is providing stimulus on a scale only seen in WWII, the GFC, and COVID.

- Corporate spending – AI investment may dwarf the shale and telecom booms. Morgan Stanley projects big-tech capex will rise 70% this year, and 2.5x between 2024–27, not including the power buildout required.

- Bank deregulation – Morgan Stanley also estimates lower capital requirements could free USD 1tn in risk-weighted capacity, while looser M&A rules support activity.

At the same time the Fed is becoming more dovish, it is expected to cut 3 to 5 more times until end of next year. Policymakers fear labor weakness, but if growth holds, then deficits, capex, deregulation, and rate cuts could drive a 1990s-style melt-up.

To sum it up, we think the bull market remains underappreciated and under-owned. Strong fiscal support, rising corporate investment, lighter regulation, and a Fed moving toward rate cuts all increase the odds of further upside, rather than signaling that the rally is running out of steam.

Positioning

Since April’s liberation day crash, retail investors and corporates (via buybacks) have been buying the dips. Systematic strategies have followed as volatility calmed down. In the meantime, discretionary managers have stayed on the sidelines, according to analysis from Deutsche Bank.

From a sentiment point of view, all-time highs coupled with only moderate consensus risk appetite is an attractive setup. Skepticism toward this bull market remains strong. Ironically, this caution helps extend the rally: the longer managers stay on the sidelines, the more fuel there is when they’re forced to buy back in. When sentiment finally turns overheated and skeptics capitulate, it will actually be time to turn more defensive.

From a yield perspective, we think as long as 10-year US Treasuries stay below 4.5%, there is no major risk. Currently the yield stands at ~4.1%, which is 10 bps higher since the Fed cut its policy rate in September. A general rule of thumb is that the 2-year Treasury yield captures the market’s view of a monetary policy cycle. The 2-year – at 3.54% – is still trading 54 bps below the effective Federal Funds rate. This strongly implies the Fed should cut two more times to catch up to the market before re-evaluating their rates outlook.

During prior US shutdowns, the following trades did well:

1) long gold and silver

2) short US dollar

3) long stocks – across the board, including small caps and EM

While these moves would imply additional tailwind for our balanced portfolios, we don’t think that the shutdown will be a decisive factor for markets and do not expect to engage in portfolio changes based on it.

AI bubble risk?

The surge in AI investment and stock valuations has sparked comparisons to the dot-com era. Critics argue that enthusiasm is running ahead of real-world results: valuations appear stretched, the return on investment is unclear, infrastructure and power constraints are emerging, and escalating costs could pressure business models.

We think this isn’t a repeat of the late 1990s – at least not so far. Back then, investors threw money at any company with “.com” in its name. Today’s AI leaders (also known as the “hyperscalers”) – Microsoft, Amazon, Alphabet, and Meta – are among the most profitable and well-capitalized firms globally, funding expansion organically rather than via debt.

Skeptics often highlight the lack of productivity gains as proof of a bubble. But McKinsey estimates AI could unlock up to USD 4.4 trillion annually in productivity, and early adopters are already reporting efficiency improvements of up to 30% according to a meta-study by Goldman Sachs.

The hyperscalers can sustain higher capex because they generate massive cash flow, unlike speculative startups of past cycles. And the broader market context is different: since 2019, the S&P 500 has risen 125%, with 76% driven by earnings growth and 19% from dividends – evidence of fundamentals, not froth, according to Ryan Detrick from Carson.

In short, while AI could eventually turn into a bubble, the current rally is supported by strong earnings and balance sheets of big tech megacaps, and is not characterized by speculative excess.

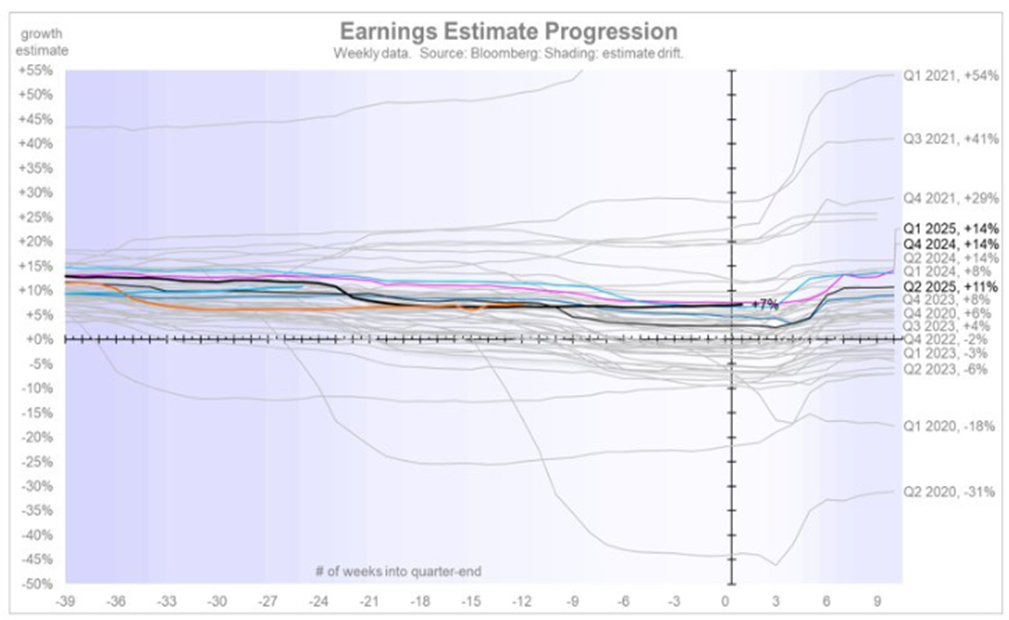

Another strong earnings season ahead?

Source: Fidelity, Jurrien Timmer, data as of 29.09.2025

With the US earnings season just weeks away and estimate revisions still strong, we expect the current 7% growth forecast may again prove too conservative, as in recent quarters. Earnings growth could end up in the low double digits.

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, BCA Research, Renaissance Macro, BlackRock, 3Fourteen Research, TS Lombard

-

Markets, Volatility & Productivit...Market View February

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 03.10.2025.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.