Market View September

AI Momentum, Fed Shift, Inflation Watch

created by Ullrich Fischer, Chief Investment Officer

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

- Equities near records – Stock markets remain close to all-time highs, supported by strong earnings, accelerating momentum in artificial intelligence, and rising confidence that the Federal Reserve is preparing to shift toward easier policy.

- For now, markets are discounting political pressure on the Fed. This stance could reverse quickly if inflationary forces re-emerge or if the Fed were to pursue overly loose policy.

- US Trade policy – Should the US Supreme Court surprisingly strike down reciprocal tariffs, the administration still has robust levers such as Sections 232 and 301 to advance its trade agenda. However, these tools are slower to implement, potentially deferring stagflationary tariff effects into 2026.

- Goldilocks scenario – Our central case continues to assume gradual Fed easing through 2026. Growth is expected to slow without collapsing, while inflation risks remain largely contained, sustaining a “just right” macro environment for risk assets.

- Positioning – The equity bull market is intact, with pullbacks seen as opportunities to increase exposure. Seasonal softness may create attractive entry points. The main risk to this view – though not the base case – would be a sharp resurgence of inflation and/or a significant rise in nominal yields.

- Strategic outlook – Fed independence appears increasingly strained at the very moment inflation risks are resurfacing. This dynamic underpins demand for “debasement” trades. High sovereign debt burdens further tilt the landscape toward financial repression for the foreseeable future.

Monthly Review

- US equities remain near record highs, supported by robust earnings momentum and growing conviction that the Fed is nearing a policy pivot. Bond markets now fully price in two cuts this year and three to four more in 2026, which would bring the policy rate to roughly 3% by the end of 2026.

- Artificial intelligence continues to dominate the cycle. While short-term concerns over investment saturation may flare up again, the potential productivity and margin payoff is enormous.

- In this environment, rate cuts are inherently reflationary, amplified by a synchronized global fiscal push across Japan, Germany, China (partially), and the US.

- At the long end of the curve, the 30-year Treasury yield premium over the 10-year has widened to 70 bps – the largest since the 2021 inflation surge – underscoring sensitivity to long-term inflation expectations.

- Credit markets show stretched valuations, with high yield spreads compressed to levels last seen in 1999 and 2007.

- Geopolitical risks remain elevated. Efforts to strike a peace deal with Russia appear fruitless, while Modi, Xi, and Putin signal renewed alignment.

- Treasury Secretary Scott Bessent has launched the Fed chair interview process this week. In our assessment, Christopher Waller has emerged as the frontrunner.

- The FOMC consensus – with Powell notably shifting – is increasingly adopting Waller’s academically grounded view: rate cuts are warranted to cushion a softening labor market, while tariff-driven inflation should be treated as a one-off price-level adjustment. Powell’s Jackson Hole remarks underscored this shift, signaling stronger alignment with Waller’s stance.

- That said, the upcoming employment report (Sept 5) and CPI release (Sept 11) will be crucial ahead of the Fed’s Sept 17 meeting.

- We anticipate clearer guidance from the White House shortly thereafter on its preferred candidate for the next Fed chair.

Market Development

World

- The Trump administration has suffered a string of legal defeats. A federal appeals court struck down most of Trump’s reciprocal tariffs as unlawful under IEEPA (International Emergency Economic Powers Act), while other courts blocked his use of National Guard troops during immigration protests and his expanded “expedited removal” policy.

- Trump plans to appeal the tariff ruling to the Supreme Court, though a decision is unlikely before early 2026.

- The Supreme Court’s conservative majority often aligns with Trump; three of its justices were appointed by him. Recent rulings have split 6–3 or 5–4 in his favor.

- Goldman Sachs estimates the overturned measures accounted for 8pp (percentage points) of the 11pp rise in effective tariffs but still expects the administration to rely on alternative levers, keeping tariff rates on track to rise toward ~17pp.

- Separately, Treasury Secretary Bessent has floated declaring a national housing emergency – the first since the Great Recession – to justify aggressive intervention in housing markets. Such a move would potentially be supportive for risk assets (more ‘run-it-hot’ policies, i.e. the attempt to ignite an economic boom for 2026 through deregulatory and supportive fiscal measures). Absurdly, Trump has declared nine national emergencies since taking office.

Europe

- Optimism around a Ukraine peace breakthrough has faded, with talks again stalled. The situation now appears locked in stalemate, suggesting Moscow may have engineered the breakdown from the outset.

- For Europe, sovereign risk pressures are rising, with the UK and France most exposed. We see these as politically driven rather than systemic. The UK “fiscal black hole” narrative to us looks overstated, while Germany retains fiscal space and the ECB is unlikely to tolerate spiraling spreads like it did in the 2010s.

- While France remains politically fragile, the ECB’s toolkit – especially the TPI (Transmission Protection Instrument) launched in 2022 to contain sharply rising yield spreads – helps to limit crisis risk.

Switzerland

- Swiss equities so far have shrugged off Trump’s 39% tariffs indicating that the market still expects resolution – we agree.

- Despite a stronger franc and steep trade barriers, the SMI gained 4.7% in USD total return terms, beating both Euro Stoxx 50 (+3.1%) and the S&P 500 (+2%). In CHF too, Swiss stocks outperformed. Pharma leaders Roche and Novartis drove upgrades, with earnings-per-share estimates raised at twice the pace of Europe. Yet, Swiss equities still trade at just an 13% forward Price-to-Earnings premium to Euro Stoxx 50, well below the ~25% average of the last 10 years. Easing tariff uncertainty may unlock upside potential.

Goldilocks to hold well into 2026 … if inflation behaves

Rising global yields have once again stirred fears of looming fiscal crises around the world. The pattern is familiar: when yields rise, concerns focus on fiscal sustainability; when they fall, the debate shifts back to recession risk.

At Jackson Hole, Powell struck a dovish tone, highlighting softer payroll revisions and signaling greater weight on employment over inflation – a notable shift in the Fed’s reaction function. This path resembles 1995, when the Fed cut prematurely on weak jobs data before pausing as revisions showed renewed strength.

We do expect a September cut, followed by gradual (quarterly) easing into H2 2026 if growth weakens and inflation remains contained. But the data picture is noisy: ADP private payrolls suggest less fragility than the NFP reports from the U.S. Bureau of Labor Statistics (BLS), yet markets mostly ignore them.

A rebound in hiring could force the Fed to backtrack if they come out too dovish now, particularly as fiscal stimulus and tariff pass-through tilt inflation risks higher. This tension underpins our view that a slow, quarterly cutting cycle is the best policy approach.

Political pressure complicates the picture. Trump continues to push for large and rapid cuts, while attempts to remove FOMC members and “take over” the FOMC highlight risks to Fed independence.

As former US Treasury Secretary Larry Summers warned this week, “We are playing with fire in terms of inflation expectations.”

Markets have so far largely dismissed Fed independence concerns, but risks rise if (1) inflation accelerates due to tariffs, immigration policies, or supply shocks, and (2) the Fed cuts without sound reasoning but under political pressure. Bond markets and the USD would react negatively, with debasement trades like gold and crypto likely to benefit as perceived safe havens.

For now, however, the Goldilocks backdrop – moderate growth slowdown, inflation elevated but without clear upward momentum, and gradual easing – looks intact into 2026. OPEC supply increases ease near-term inflationary pressure, we think. That said, structurally, supply-driven inflation shocks remain the key threat to both bonds and equities, while demand-driven booms can support equities even if bond yields rise.

History offers a note of caution. In 2024, 74% of global central banks eased policy, yet yields still moved higher. In May 2025 alone, 15 global rate cuts coincided with a surge in long-term yields, driven by fiscal deficits and inflation concerns. Technical pressures – including heavy post-summer issuance, abundant duration supply, and constrained bank balance sheets – further amplified the move. In this context, a rate cut should not be assumed to automatically translate into a broad decline in yields. On the contrary, we expect the opposite effect this time, as long-term inflation expectations are likely to continue rising. That said, as long as the Fed does not cut rates too aggressively, the Goldilocks path should remain intact.

Positioning

We continue to see a favorable backdrop for equities over the medium term. The Fed is easing into a slowing but non-recessionary growth phase, while fiscal stimulus, deregulation, and positive earnings revisions provide support. Seasonal weakness in August/September is unlikely to derail this view. We are surprised by the muted equity pullbacks, limited to 3–4% so far and would see a 6–8% correction as a buying opportunity. We expect the bull market to extend well into H2 2026. The main risk is an upside surprise in inflation and yields, though this remains a moderate concern for now.

The September 17 Fed meeting is pivotal. Powell has signaled a shift to labor market data as the key driver, reinforcing our expectation of dovish policy. A softer labor picture opens the door for looser financial conditions and continued equity gains.

An upside surprise to our bullish base case could come if courts delay or weaken Trump’s tariff agenda, pushing stagflationary effects into 2026 and creating room for rate cuts alongside fiscal stimulus. This would smooth the slowdown and possibly fuel a year-end rally driven by bearish capitulation.

Tactical Asset Allocation – Quick Takes

- Fixed Income: Long duration remains unattractive and should not be relied on as a portfolio hedge. Short-duration IG credit remains acceptable.

- Equities: Quality large-cap growth, EMs (on weaker USD), and AI beneficiaries remain attractive.

- Goldman Sachs: The dominance of US mega-caps reflects their superior earnings power over the past decade.

- Evercore ISI: “AI is bigger than the Internet” with adoption now inflecting upward.

- UBS: Global AI revenues could reach ~$1.5T annually.

- In our view, EM equities warrant a reduced risk premium – and therefore higher valuations – as rising political influence (e.g., diminishing Fed independence) increasingly reshapes developed markets, bringing them closer in character to emerging markets.

- Currencies: USD downside risk persists, but we think only moderate if Waller becomes the new Fed chair.

- Gold: We still see it as a strong hedge against currency debasement. Central bank demand is firm. We have been gold bulls since late 2016.

- Goldman Sachs now forecasts $4,000/oz by mid-2026, with potential upside toward $5,000 if Fed credibility erodes.

- “We estimate that if 1% of the privately owned US Treasury market were to flow into gold, the gold price would rise to nearly $5,000/oz, assuming everything else remains constant.”

- Alternatives: Favor hedge funds given doubts about Treasuries/USD as safe havens.

- Crypto: Regulatory progress in the US could boost adoption. Stablecoins may drive Treasury demand, but counterparty risks remain. Crypto allocations can improve risk/return of multi-asset portfolios but should be kept small and rebalanced semi-annually due to volatility.

Strategic Views

- Fed independence is weakening at the same time as inflation risks re-emerge.

- Government spending remains structurally higher post-crisis.

- We anticipate further intensification of financial repression, ultimately leading to some form of yield curve control – but likely not before late 2027 – coinciding with a potential peak in the debasement trade.

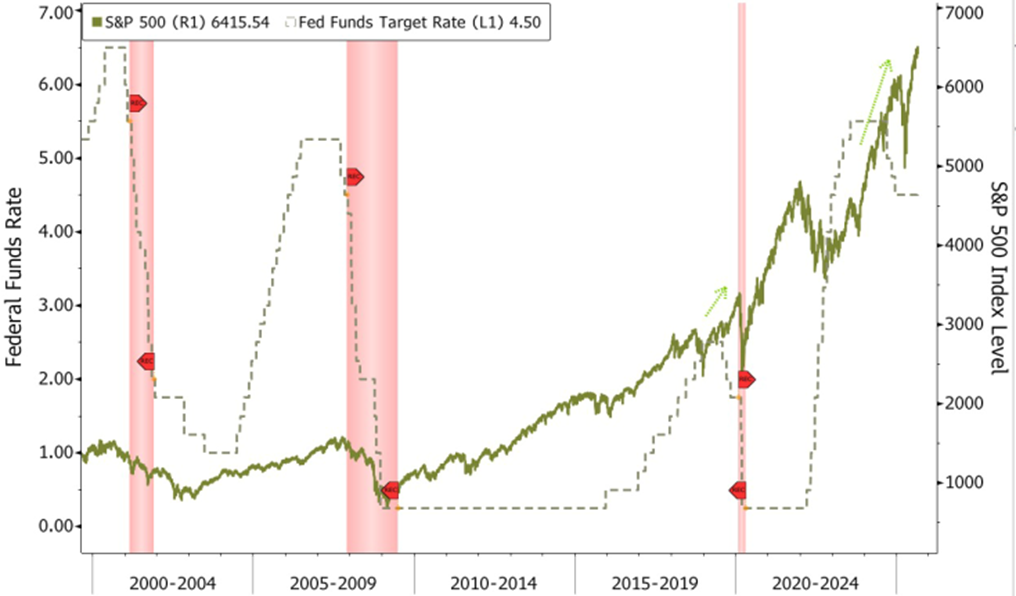

Fed to resume rate cuts in a non-recessionary environment – a bullish catalyst?

Source: Bloomberg, Morgan Stanley

The chart shows the Fed Funds Rate (dashed) and S&P 500 (green) from 2000–2025, with US recessions in red. Fed cuts during downturns (2001, 2008, 2020) coincided with equity turbulence before recovery. In contrast, the 2024 cut outside recession sparked a sharp equity rally – underscoring how the context of rate cuts shapes market outcomes.

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, BCA Research, Renaissance Macro, BlackRock, 3 Fourteen Research, TS Lombard

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 04.09.2025.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.