Market View August

Rally Faces Headwinds: Markets Remain Resilient, but Correction Risks Rise in Q3

created by Ullrich Fischer, Chief Investment Officer

-

Markets, Volatility & Productivit...Market View February 2026

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

- Equity markets extended their rally for a third consecutive month, led by US Tech, with strong momentum leaving limited entry points. Structural sector leadership and good earnings continue to support the medium-term trend.

- We remain bullish on equities into 2026, but Q3 carries tactical risks. Signs of complacency – such as 2021-level retail trading, historically tight credit spreads, and crowded positioning – suggest a pullback is likely, which we’d view as healthy and an opportunity to add.

- The US dollar rebounded on perceived trade wins and oversold technicals, but mounting pressure from Trump and the potential appointment of a new dovish Fed chair could lead to looser real rates – posing medium-term downside risk for the USD.

- Sharp downward revisions in recent US job reports highlight both a softening but still balanced labor market and raise concerns about the reliability of headline macro data for markets and policymakers.

- Beyond the latest labor data, US economic performance remained largely resilient, consistently beating expectations and widening the growth gap versus other developed markets – supporting risk assets.

- Economic consensus holds that tariffs act primarily as a regressive tax on consumers, with their impact only emerging once costs fully pass through – suggesting we’re only now beginning to see the effects. We believe the economy is still mid-way through a U-shaped recovery, which helps explain Trump’s shift toward pro-growth policies aimed at delivering a nominal boom by 2026. As tariff-related pressures take hold, we remain alert to signs of weakening growth.

Monthly Review

- Equity markets are becoming less reactive to trade headlines, as seen in the subdued response to the recent US–EU agreement. This reflects headline fatigue and a declining influence of trade news on asset prices. While tariff effects haven’t yet shown up clearly in macro data, that delay shouldn’t be mistaken for absorption – impact is still expected, even under a moderate effective tariff regime.

- US Q2 earnings have generally surpassed expectations, with standout results from mega-cap tech firms like Microsoft and Meta, strengthening the argument for continued investment in AI infrastructure. However, companies that missed estimates faced disproportionately sharp sell-offs, and the longer-term productivity gains anticipated from AI have yet to be substantiated—leaving their full impact still to be proven in the years ahead.

- The Q2 US GDP release, along with the June JOLTS report and July’s Consumer Confidence Index, collectively point to a U-shaped recovery. However, the data remains noisy and unreliable. GDP figures, in particular, were skewed by significant trade distortions – Q1 experienced a surge in imports as firms moved to front-load ahead of tariffs, followed by a steep drop in Q2, obscuring the underlying growth trajectory.

- The Q3 Quarterly Refunding Statement met expectations, with Treasury Secretary Bessent reaffirming a strategy focused on maintaining calm in fixed income markets. Key highlights include:

- No increase in coupon auction sizes, a sign of commitment to a liquidity-friendly issuance policy.

- Rebuilding the Treasury General Account via short-term bills, avoiding pressure on duration markets.

- These coordinated steps clearly underscore the administration’s intent to preserve financial stability and support the broader environment for economic and asset price expansion – an emerging hallmark of what the Trump administration is calling the new “golden age.”

Market Development

World

- US employment growth slowed sharply in July, with substantial downward revisions to the May and June figures – bringing a potential September Fed rate cut back into focus.

- In response, Trump dismissed the head of the Bureau of Labor Statistics (BLS) and stepping up efforts to position a Fed “shadow chair” in order to exert greater influence over monetary policy.

- Job gains were revised drastically:

- June: revised from 147K to 14K

- May: revised from 139K to 19K

- As a result, the three-month average for non-farm payrolls has dropped to approximately 35K, well below the pre-revision trend of around 150K.

- Job gains were revised drastically:

- Cyclical sectors are increasingly under strain: residential construction declined for the second consecutive month, and job losses in manufacturing are accelerating, accompanied by further negative revisions. Excluding education and healthcare, the US economy even shed jobs in July.

- That said, the labor market still appears broadly balanced. The unemployment rate has remained within a historically low range of 4.0% to 4.2% over the past 13 months. While labor demand is softening, this has been largely offset by a parallel decline in labor supply—likely driven, at least in part, by the effects of Trump’s stricter immigration policies, which may be constraining the available workforce.

Europe

- Despite positive coverage of the US following the recent US-EU trade agreement, we believe the EU holds the institutional advantage as negotiations enter the more technical phase. While Trump celebrates the headlines, EU negotiators may well be focusing on the fine print to regain some ground.

- European equities, though no longer considered cheap, are still trading at a significant discount to the S&P 500 – even after adjusting for sector composition differences. Earnings downgrades since Q2 have largely stemmed from euro appreciation rather than deteriorating fundamentals. In contrast to the US, where growth sectors dominate, Europe’s market leadership is rooted in value, especially across the financial sectors. Notably, certain value areas such as European banks have outperformed the US “Magnificent 7” tech-stock cohort this year.

Switzerland

- Despite extended negotiations, the US has imposed a steep 39% import tariff on Swiss goods. This rate is significantly higher than the 31% rate floated in April and far above the 15% rates secured by the EU, Japan and South Korea. Bake Economics estimates that the proposed tariff would lower Swiss GDP growth by 0.3 percentage points.

- One theory is that Switzerland has not been able to offer the US the same kind of concessions as other countries, having unilaterally scrapped industrial tariffs and simplified approval for medical devices. But as we expect negotiations to continue, the current 39% rate should not yet be considered final.

- The Swiss National Bank’s response will largely depend on the franc’s performance, especially against the USD. While the Swiss currency has weakened in recent days, it remains nearly 8% stronger than its level before 2 April – adding pressure to an already fragile inflation outlook that teeters on deflation. We still expect a rate cut in September, contingent on the franc’s trajectory.

- Looking forward, mid-cap companies trading on the SMIM index appear to be better positioned for a potential re-rating that is supported by diminished pharmaceutical tariff risks, lower USD exposure and a more defensive sector composition. By contrast, large caps on the SMI index face growing valuation headwinds. Key concerns include volume softness and obesity drug exposure at Nestlé, alongside patent expirations and pipeline uncertainty at Roche and Novartis.

US exceptionalism re-emerges, but risks of a Q3 pullback linger

The narrative of US exceptionalism is regaining traction, at least in the headlines, with stories about advantageous trade agreements, the perceived breakout success of AI hyperscaler investments, pro-business regulatory shifts and market-friendly fiscal initiatives led by US Treasury Secretary Bessent.

While the macroeconomic backdrop remains broadly resilient and still fits the “Goldilocks” narrative – neither too hot nor too cold – early signs of mounting inflationary pressure and labor market softening are becoming more apparent. Tariff-induced inflation is beginning to surface in the data and is likely to accelerate, with effective U.S. tariff rates expected to stabilize between 15% and 20%, while roughly one-third of all U.S. imports will reportedly remain exempt, according to Bloomberg. This evolving dynamic raises the risk of policy missteps – particularly on the monetary side – as the Fed navigates an increasingly complex trade-inflation-growth triangle.

As a result, we believe that the broader outlook remains bullish but acknowledge near-term tactical risks that could trigger a market pullback. At the core of our constructive medium-term outlook lies an unprecedented wave of long-term investment by US corporations. S&P 500 firms now annually spend in excess of USD 1.5 trillion on capital expenditure (CapEx) and R&D nearly double the level a decade ago. This is starting to translate into measurable gains, notably in AI infrastructure, with early signs of productivity enhancements and new revenue streams emerging across industries.

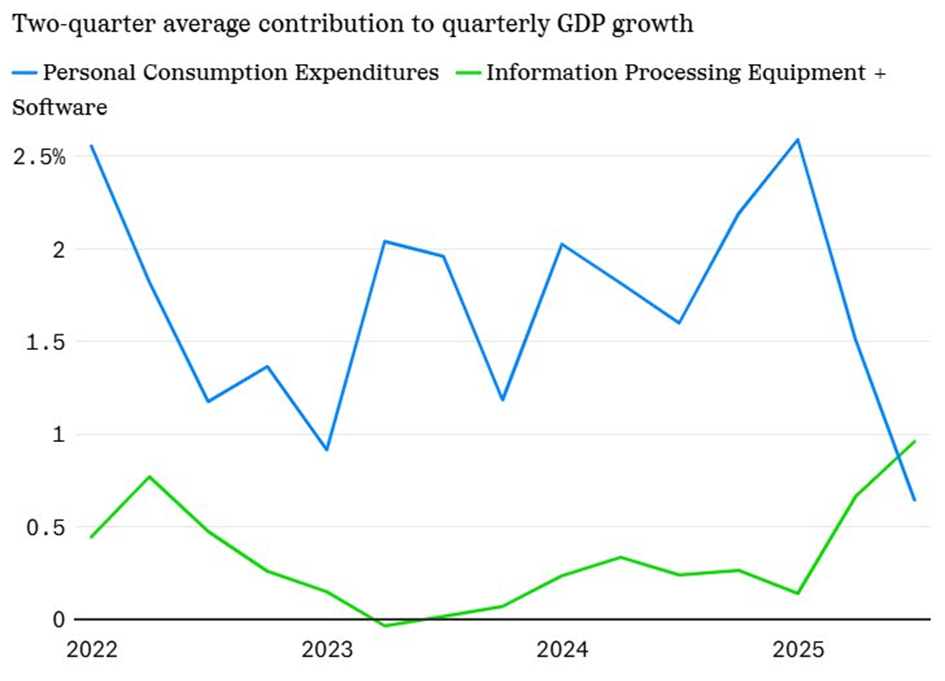

- According to Renaissance Macro, AI-related business spending in 2025 is contributing more to US GDP than all consumer spending combined.

- As Chris Weston of Pepperstone notes: “The massive levels of capital expenditures are starting to get monetized…and pay off pretty handsomely.” CapEx is now feeding into productivity, revenue growth and margin expansion, setting the stage for sustained earnings improvement.

- Meanwhile, US corporate buybacks continue to outpace new equity issuance by a 4:1 ratio. This persistent reduction in the number of shares available for trading boosts the earnings per share and underpins market resilience. Historically, such buyback activity has signaled management confidence and provided support to equity momentum.

Recent policy developments, namely Trump’s pivot to an aggressive pro-growth agenda, have aligned with market interests. At the same time, new uncertainties and questions around the Fed’s independence have come into play. Trump is only the fourth US president to have paid a visit to the Federal Reserve, ostensibly aiming to further pressure Fed Chair Powell into cutting interest rates.

- With no material effort to rein in federal spending, Trump appears intent on engineering economic and market strength to offset a USD 37 trillion debt burden and a 6-7% budget deficit and seek political capital ahead of the 2026 midterm elections.

- This strategy depends on looser monetary policy, yet Powell’s hawkish posture – grounded in tariff-related inflation concerns – casts doubt on rate cuts this year. Our view is that two rate cuts can still be expected, even more so given the recent employment report – which had not been released when Powell’s latest press conference took place.

- With over USD 300 billion in tariffs set to be annualized in 2025 – effectively amounting to a tax on US households and businesses – we expect margin pressure and demand drag to build. The risk is compounded as significant net fiscal stimulus won’t arrive before 2026, creating a near-term vacuum if monetary policy waits too long.

- Adriana Kugler’s unexpected decision – announced on August 1 – to step down from the Fed Board roughly six months early gives Trump an earlier-than-anticipated chance to nominate a replacement, potentially positioning a successor to Chair Powell. Trump likely aims to secure Senate approval before the Sept 17 FOMC, ensuring three votes for a cut then (there were already 2 votes for a cut in July).

- Looking at betting markets, Kevin Warsh is currently the frontrunner for becoming the next Fed Chair when Powell’s term ends in May 2026.

We believe that, in the near term, market focus is shifting from trade developments to the Federal Open Market Committee – particularly its evolving composition and how it assesses incoming economic data. With critical inflation and employment reports due ahead of the September meeting, we expect the Fed to resume rate cuts. In light of recent labor market developments, a failure to act could be viewed as a policy error.

Positioning

In retrospect, our early Q2 positioning calls proved timely. We identified a peak in uncertainty and increased equity exposure, particularly in tech, as Trump’s retreat from an aggressive trade posture triggered a sharp rebound in corporate earnings guidance. Notably, the relative valuation of Big Tech versus the S&P 500 hit 10-year lows in mid-April. US and global equities have since surged to new all-time highs.

While the rally of the past three months reflects macro tailwinds – mainly declining uncertainty, resilient growth and improving liquidity – it is also firmly grounded in fundamentals. Stronger earnings and tangible productivity gains, especially from AI, are lending credibility to valuations.

However, short-term sentiment appears stretched and the “wall of worry” that underpinned the rally has crumbled in July.

- Retail participation in equity markets has risen above 20% of trading volumes, levels last observed during the speculative frenzy of early 2021.

- Bloomberg’s global credit index – spanning investment-grade and high-yield debt – shows spreads tightening to levels not seen since mid-2007, reflecting growing complacency.

- Nomura reports that global commodity trading advisor (CTA) equity exposure is at the 100th percentile. On the other hand, Citadel’s Scott Rubner thinks that while systematic funds still have dry powder, their positioning may peak by September and leave markets vulnerable to volatility-induced de-leveraging.

Given seasonally weak patterns in August and September, we believe the market is vulnerable to a 5-8% tactical pullback. We would view this as a healthy development and an attractive entry point to add risk into 2026 not only across equities, but also potentially into gold and crypto (our three preferred debasement trades).

The key themes for us at the moment are as follows:

USD view: Tactical rebound within a structural downtrend

- While the USD appears to be in a medium-term bear trend, a tactical rebound is underway. This is catalyzed by the recent trade deals with Japan and the EU that markets have interpreted as political wins for Trump. The relative weakness in haven currencies, such as the yen and the franc, is also providing support.

- We still anticipate renewed downside once changes in Fed leadership are announced later this year. As previously expressed, we are concerned about the possibility of a loyalist Fed Chair undermining its perceived independence. Until then, the USD should continue to strengthen modestly, especially if equities correct.

AI: From trend to structural transformation

- AI and automation continue to drive a structural shift in global productivity. According to BlackRock, industrial robotics adoption is growing at 12% annually while AI-related patent filings now exceed 120,000 per year. Annual venture-capital investment in AI has also reached nearly USD 100 billion. These developments are no longer theoretical as the firms that effectively implement AI are already outperforming their peers in productivity, revenue and margin growth.

- Michael Harnett from Bank of America: “The railroad stocks were more than 60% of market cap in the late 1880s… why can’t the Magnificent 7 get to the same level.” (The Mag 7 currently have an approx. 35% combined weighting in the S&P 500.)

Expansion of the global opportunity set

- While the US remains at the heart of innovation, international exposures especially in Europe and emerging markets (EM) are increasingly compelling. Europe’s fiscal policy has surprised to the upside, China’s stimulus cycle is turning and weakness in the US dollar continues to support EM performance over the medium term. Sector diversification, valuation discounts and macro tailwinds are also enhancing the appeal of multi-asset portfolios.

Sustaining the Bull Market

- We currently have a positive output gap, loose fiscal policy, and moderately tight monetary policy. If the Fed turns dovish in 2026, we could see a repeat of the late 1960s setup—higher inflation, a weaker dollar, and potential yield curve control sometime in the next 2-3 years.

- Equities may benefit, similar to past melt-ups in 1968, 1999, and 2021, before inflation or stretched valuations eventually end the cycle.

- We expect the bull market to continue into 2026. Equity valuations remain elevated but are seen as largely justified by upward earnings revisions and improved macro clarity. Similar setups, marked by strong earnings breadth and investor rotation into quality growth stocks, have historically sustained prolonged bull markets.

AI spending supports US growth

Source: Renaissance Macro

According to research from Renaissance Macro, the recent surge in AI-driven capital expenditures – covering data centers, hardware, and software – has surpassed consumer spending as the leading contributor to U.S. GDP growth, despite consumer activity traditionally making up more than two-thirds of annual output. In effect, AI-related CapEx now represents a larger share of GDP than any technology investment since the advent of the railroad. It will be critical – as we anticipate – that this wave of investment delivers widespread productivity gains – otherwise, the risk of substantial write-downs in the coming years remains considerable.

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, BCA Research, Renaissance Macro, Black Rock, 3 Fourteen Research, BAK Economics

-

Markets, Volatility & Productivit...Market View February

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 02.08.2025.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.