Market View June

Resilient stock markets have more room to run

created by Maximilian Mantler, Deputy Chief Investment Officer

-

Markets, Volatility & Productivit...Market View February 2026

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

- Global stock indexes are near all-time highs, largely shrugging off trade tensions and US budget concerns.

- The US economy is holding up well, with solid GDP growth, stable employment, rising corporate earnings and a recovering money supply growing at 4.4% annually.

- Eurozone inflation fell below 2% in May, prompting the ECB to cut rates to 2.00% and showing signs of further easing.

- Switzerland’s economy grew by 0.8% in Q1 but faces Q2 headwinds from manufacturing weakness and US tariffs; with inflation turning negative, the Swiss National Bank (SNB) is expected to cut rates to zero in June and possibly below later in the year.

- The US administration’s pivot toward pro-growth policies is currently bullish for equities despite long-term fiscal worries.

- A genuine return to hardline trade policy is unlikely because of the short timeframe between the expiration of reciprocal tariff pauses and the 2026 midterm elections.

- We view pullbacks as tactical opportunities to add risk, supported by expanding liquidity, solid economic data and strong share buybacks – all pointing to higher stock prices over the next 6-12 months.

- The 2025 market reflects growing concern about currency debasement, favoring hard assets (e.g. gold, Bitcoin) and large-cap tech equities with pricing power. In this environment, we consider the “Magnificent 7” stocks a standout allocation.

Monthly Review

Recovery

Global stock indexes recovered, trading above the levels of April 2, – when extensive US tariffs were announced on the so-called “Liberation Day” – and only slightly below all-time highs. In the US, large-cap technology stocks took the lead. Neither renewed trade uncertainties nor worries about the US budget, including Moody’s credit downgrade of the U.S., could derail the rally. Trump’s threats and subsequent backtracking undermine his credibility and reveal his ultimate intention: to strike deals. The proposed (“One Big Beautiful”) budget reconciliation bill, currently making its way through Congress, would place an additional burden on the US budget. Moody’s credit downgrade of the US to AA+ is sensible, following S&P and Fitch who made their downgrades already in 2011 and 2023. Yet for now, the bill’s long-term fiscal consequences are overshadowed by its short-term positive impacts on economic growth.

Market Development

World

The US economy is holding up well despite the tariffs and considerable policy uncertainty. At the moment, the negative impact can be measured more by a loss of confidence among company managers and consumers rather than hard data. Strong GDP growth for Q2 is expected, reversing the negative 1Q report that was due to large imports in anticipation of tariffs. In addition, employment remains stable, inflation is above the US Federal Reserve (Fed) target but not rising, and the aggregate earnings of S&P 500 companies have seen a double-digit increase compared to last year. Also supportive for the economy and financial markets is the US money supply (M2), which reached a new all-time high in April for the first time in three years. The annual growth rate, now at 4.4%, has been rising for months. For context, during the post-COVID boom in 2021, the annual growth rate peaked at 25% before dropping to -5% in 2023 during the Fed’s hiking cycle.

Europe

In May, inflation in the Eurozone fell below the 2% threshold for the first time since last fall. Core inflation also dropped to its lowest level in almost three and a half years. These latest inflation figures, combined with cooling wage growth and the negative effects of US tariffs on growth, paved the way for the European Central Bank (ECB) to cut its policy interest rate by another 0.25% to 2.00%. The ECB emphasizes its data-dependent approach to policy but leans more towards additional easing during the second half of the year.

Switzerland

Switzerland’s economy expanded by 0.8% in Q1, the fastest pace in two years, mainly due to front-loaded exports to the US and broad-based growth in the services sector. Yet the growth spurt may be short-lived as the economy faces downside risks in Q2, driven by a slump in manufacturing and the impact of US tariffs. Industry-specific tariffs on pharmaceuticals would be particularly harmful. Meanwhile, inflation turned negative as consumer prices fell 0.1% from a year ago. Because of the franc’s strength, imported goods are having a deflationary effect. The SNB is set to cut interest rates to zero at its next meeting on June 19 – and could even go back into negative territory in the second half of the year. The yields of Swiss government bonds with maturities of up to 5 years are once again negative.

Markets climb wall of worry amid policy shift and earnings resilience

The US administration has decisively shifted toward the pro-growth, pro-market pillars of the Trump 2.0 agenda, effectively curtailing the “detox period” that US Treasury Secretary Bessent had envisioned back in February. This strategic pivot aligns with the strong performance of US equities in May and strengthens the case that fiscal expansion may positively surprise consensus growth expectations, which, in our view, still overstate the probability of a recession. While we do not consider fiscal largesse to be a bearish catalyst for the 2025 and 2026 fiscal years, this may change in the years that follow.

In this evolving regime of currency debasement, we expect a combination of large-scale fiscal and monetary interventions aimed at suppressing the long end of the yield curve. Such a policy backdrop would materially favor risk assets, even as it increases the long-term risks for bond markets. While a U-shaped economic trajectory may still lie ahead, risk assets could look through a temporary growth slowdown and sustain their V-shaped recovery.

In support of this perspective, the Citi U.S. Economic Surprise Index has climbed to its highest level since February. It was boosted in part by the pause in tariffs that has helped to restore confidence and activity. Corporate resilience is equally notable: only 3% of S&P 500 companies withdrew their 2025 earnings guidance during the Q1 reporting season, while upward revisions outpaced downward adjustments by almost 2:1. This indicates that macro uncertainty and tariff-related concerns have, for now, failed to significantly disrupt corporate America’s profit outlook.

Looking ahead, we expect growing investor capitulation to the upside in the coming quarters. Many market participants remain fixated on tariffs rather than recognizing the broader and now more bullish range of outcomes ushered in by Trump’s policy pivot in April. On the trade front, recent judicial pushback against Trump’s tariff agenda has introduced some short-term uncertainty, but we view this as noise. The broader market is certain, as are we, that the administration will find alternative legal channels to sustain its tariff strategy. For that reason, we believe headline-friendly trade deals are not only likely but also necessary, though negotiations may become more drawn out as counterparties attempt to buy time.

It is worth mentioning Trump’s strong reactions to the adverse court rulings and the term circulating in the financial community to describe his TACO approach to trade (short for ”Trump Always Chickens Out”). To save face in trade negotiations, Trump may double down on his tariff agenda. But his actions so far suggest he is more interested in negotiating than fundamentally overhauling global trade. While concerns about a Liberation Day 2.0 scenario may trigger temporary volatility, we see such episodes as tactical buying opportunities rather than structural threats.

Given the limited timeframe between the expiration of reciprocal tariff pauses and 2026 midterm elections, we do not believe that the administration will return to its genuinely hardline stance on trade. In the event of a 5-10% market pullback, we would advise staying focused on the broader bullish market environment, tuning out the panic and using the opportunity to buy the dip.

A more serious concern for global investors may emerge from Section 899, a relatively obscure clause in the latest tax-and-spending bill. Section 899 calls for punitive taxation on passive US income earned by investors from countries that the U.S. deems discriminatory. This introduces a small but real risk that the trade conflict could escalate into a capital war by weaponizing US capital markets.

Meanwhile, the broader macroeconomic backdrop remains supportive. As Michael Cembalest, Chairman of Market and Investment Strategy at JPMorgan Asset Management, put it: the AI infrastructure build-out by hyperscalers represents “the bet of the century”. NVIDIA CEO Jensen Huang echoed this sentiment in May, stating: “AI is growing faster and will be larger than any platform shifts before, including the Internet, mobile and cloud.”

Investor flows also remain robust. In May, Morgan Stanley CIO Mike Wilson reported: “Our research indicates USD 15 billion of fresh demand coming into the stock market daily: 5 billion from retail, 5 billion from CTAs, 5 billion from corporates. Every dip is being bought.” In our view, the sell-side’s estimated recession probability of ~40-50% is markedly too high and should be cut roughly in half. This miscalibration continues to fuel a substantial wall of worry for the market to climb.

Positioning

While market setbacks are inevitable – whether renewed recession fears amid a U-shaped recovery, legislative gridlock that threatens the “Big Beautiful Bill” or sporadic flare-ups in trade tensions – we consider them tactical opportunities to add risk. Global liquidity is expanding, and corporate share buybacks are holding strong. US economic data is also outperforming expectations while inflation seems unlikely to deliver upside surprises in the near term. As a result, we believe that the most probable outcome is that risk assets will be materially higher over the next 6-12 months.

The 2025 market environment marks a decisive shift in investor psychology toward concerns over fiat currency debasement. This change is being driven by an unusually potent mix of aggressive US fiscal policy, persistent tariff pressures and accommodative global monetary conditions. While the pairing of large fiscal deficits and import tariffs is politically polarizing, it is also likely to generate stronger nominal growth and more persistent inflation than markets currently anticipate.

In such an environment, hard assets stand to benefit. Gold, Bitcoin and broad commodity exposures are attractive. Low-duration equities also look well-positioned, along with large multinational tech firms with pricing power and global scale. On the flip side, bonds, small-cap equities and the US dollar are likely to struggle under the weight of rising inflation risks and waning monetary credibility.

In our view, one of the most compelling equity allocations today is the “Magnificent 7” cohort. These seven companies – Apple, Amazon, Alphabet, Meta, Microsoft, NVIDIA and Tesla – have delivered ~20% annualized earnings growth over the past decade, far outpacing the ~6% achieved by the rest of the S&P 500. Their performance is the definition of a bifurcated market, where a handful of companies operate in a fundamentally different universe from the broader index. With R&D and CapEx intensity accounting for 25-40% of revenue, the companies’ discipline toward reinvestment knows no precedent and has even surpassed the mainframe boom of the 1960s. Of note, each firm is aggressively defending its competitive moat: Meta with its open-source Llama platform, Google through deep product integration and NVIDIA with its dominant CUDA ecosystem (comprehensive development suite for building, optimizing, and deploying high-performance GPU-accelerated applications). AI investments are not merely speculative bets but designed to enhance and defend core business models. Brand dominance, scale, data infrastructure and pricing power make the “Mag 7” difficult to disrupt, at least for now.

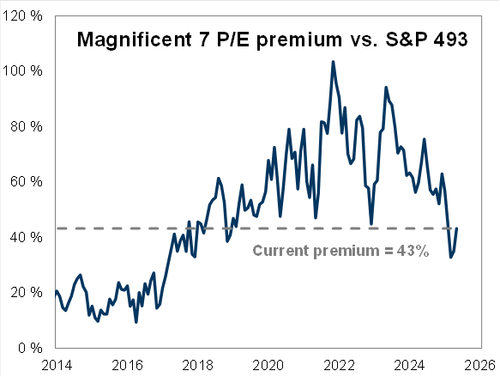

The “Magnificent 7” have the lowest valuation premium since 2019

The Magnificent 7 earnings (EPS before extraordinary items) grew by 36% in 1Q 2025, significantly beating analysts’ earnings expectations. With earnings estimates on the rise and a low valuation premium, the “Mag 7” are attractive investments.

Source: Goldman Sachs

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, LBBW, BCA Research, Charlie Bilello

-

Markets, Volatility & Productivit...Market View February

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 05.06.2025.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.