Market View March

Market Upheaval: US Protectionism and Europe’s New Path

created by Maximilian Mantler, Deputy Chief Investment Officer

-

Markets, Volatility & Productivit...Market View February 2026

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

- Political matters, notably President Trump’s tariff policies and geopolitical tensions, have added to market uncertainty. The US stock market declined while European and Chinese indexes hit new highs.

- The trade war has escalated since the US imposed additional tariffs on Chinese, Mexican and Canadian imports – with further tariffs on steel, aluminum and potentially European goods expected. The affected countries reacted with retaliatory measures.

- The European Union has responded to US isolationism and protectionism with a significant EUR 800 billion defense initiative. In addition, Germany is planning a massive EUR 500 billion infrastructure fund and substantially higher defense spending. The stimulus is expected to boost European economic growth.

- Investors have rotated from US into European stocks, particularly German, which stand to benefit from fiscal expansion. Meanwhile, US tech stocks are still facing pressure from AI competition and concern about immense capital expenditures.

- Trump will probably backtrack on tariffs if the US stock market drops significantly. Retroactive adjustments for Canada and Mexico indicate that we might have come close to the Trump put.

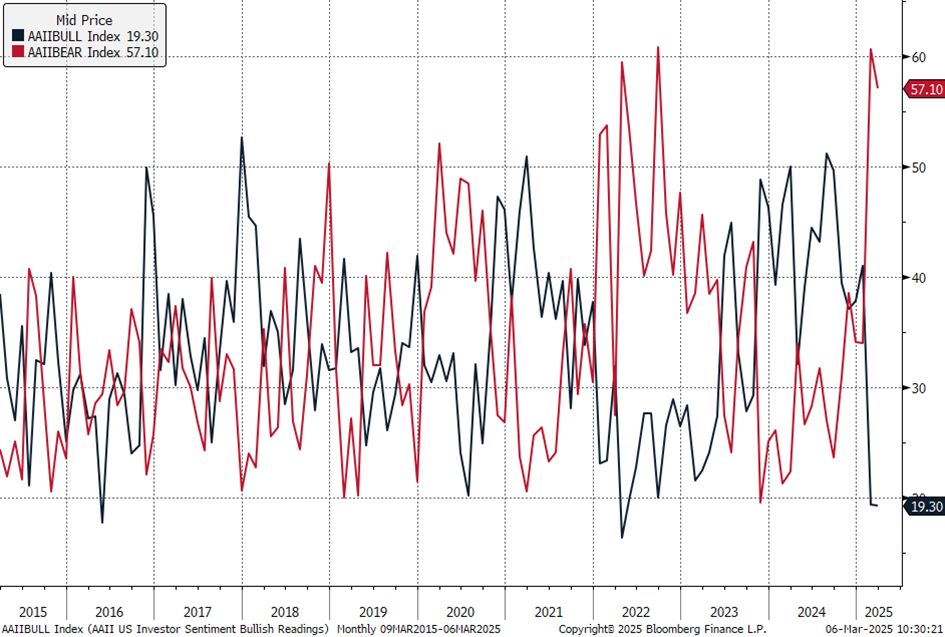

- Investor sentiment in the US has turned extremely negative, which has historically been a bottoming signal.

Monthly Review

The only certainty is uncertainty

- Politics took center stage. The unpredictability of Trump and the new US administration, especially around tariffs and the ongoing Russia-Ukraine war, has heightened the sense of uncertainty among investors. Meanwhile, the outcome of the national election in Germany looks to have substantial implications for Europe.

- The US stock market struggled at the end of February and into early March. At the time of writing, the S&P 500 experienced a drawdown of 7 % from its peak; the tech-heavy Nasdaq 100 fell by 10 %; and the small-cap Russell 2000 index dropped 15 %. By contrast, the European Stoxx 600 and Chinese Hang Seng indexes reached new highs. In general, capital moved from US stocks that performed very well in recent years to markets that could catch up.

- The US 10-year Treasury yield came down again, falling to 4.30 % compared to 4.80 % at the peak in mid-January. There are fears that consumer and corporate spending could slow materially after a period of front-loading, driven by the tariffs. In Europe, the German 10-year Bund yield climbed from 2.40 % to 2.90 %, as German stimulus is on the way.

- The price of Brent crude oil fell to USD 70 per barrel, the lowest since last September. In April, OPEC+ will increase oil production amid pressure from Trump to lower oil prices (“drill baby drill”).

Market Development

World

We are in a new trade war. On March 4th the US put new tariffs into effect. All Chinese imports are subject to additional 10 % tariffs – on top of the 10 % tariffs enacted in February. For perspective, the 20 % cumulative increase in the tariff rate exceeds all actions taken during Trump’s first term. As for imports from Mexico and Canada, a 25 % tariff has been imposed, with an exemption until April 2nd for USMCA compliant goods (about 50 % of Mexican and 40 % of Canadian imports). All three affected countries quickly announced retaliatory measures.

Further important tariff dates are March 12th, when 25 % on steel and aluminum are planned to go into effect, and April 2nd, when reciprocal tariffs will be applied on a country-by-country basis. While the date for new tariffs on EU imports has not yet been announced, it seems certain that the Continent will not be spared.

It’s also worth noting that next week, on March 14th, US government funding runs out. There is the risk of a government shutdown, but the impact on stock market is usually minor. Of note, there is no solution to the debt ceiling yet.

Europe

As the transatlantic alliance which has endured for almost 75 years starts to buckle under the weight of Trump’s shift toward Russia and US protectionism, European nations are now forced to take security into their own hands. The European Union’s “ReArm Europe” plan proposes a new mechanism to extend EUR 150 billion in loans to member states as well as allow countries to spend an additional EUR 650 billion on defense over four years without triggering budgetary penalties. The package could mobilize nearly EUR 800 billion if governments take full advantage of the new budgetary leeway.

Switzerland

Switzerland could face tariffs if the US classifies the country as a currency manipulator. Every quarter, the US Treasury evaluates Switzerland’s trade balance, current account balance and foreign currency interventions. When the Swiss National Bank (SNB) intervened in currency markets in 2020 to weaken the franc, Switzerland was labeled a currency manipulator. The US has refrained from punishment so far, but given the aggressiveness of the second Trump term, it could be different this time.

German Bazooka

Chancellor-to-be Friedrich Merz announced a sea change in German fiscal policy with a three-pillar plan. The first pillar is the creation of an off-budget infrastructure fund with a volume of EUR 500 billion over 10 years. The funds are meant to be invested in transportation, energy grids, digitalization and education. The second pillar involves a slight loosening of the debt brake for Germany’s federal states to allow for deficits of 0.35 % of GDP (currently, federal states are forbidden from taking on new debt). The third pillar reforms the debt brake to exempt defense spending above 1 % of GDP from the current fiscal rule. This essentially means that the scope for defense spending is no longer constrained.

This massive investment package requires a two-thirds majority in parliament to pass. According to a Bloomberg analysis, the EUR 500 billion infrastructure fund could mean that public investment will be raised by around 1 % of GDP over the next 10 years. If German federal states fully use their new fiscal leeway, another 0.35 % of GDP could be added. Since infrastructure projects take time to be identified, planned and implemented, the effect in 2025 could be muted, but should be clearly felt from 2026 onward. German GDP could be boosted by 1 % by the end of 2026. In the same timeframe, German stimulus could also help lift the GDP of the whole eurozone by 0.4 %.

The impact of higher defense spending on the economy will depend on the size of the package, which is currently unknown but likely a big step up from current levels. It will also depend on what the money is spent on and where products are sourced from. Spending on R&D and equipment is more sustainable than simply enlarging the military by hiring more soldiers. The main impediment to defense spending buoying the economy is the fact that the majority of military equipment comes from outside the EU, and much of that from the US. If European defense companies are certain that demand will be permanently higher, then it is likely that they will make investments to increase capacity. Since this will take some time, the immediate impact is likely rather small. Over the next several years, however, defense spending could provide a significant degree of support to the German economy, absorb some free capacity in the industrial sector and help reduce the reliance on exports to China.

In a first reaction to the German fiscal bazooka, German and European stocks have skyrocketed. Bonds on the other hand have been sold off, with the yield on 10-year German government debt surging by almost 40 basis points to 2.90 %. The yields of other European countries’ bonds have also been dragged higher. Since significantly more debt will be issued, a rise in yields is understandable. Importantly, the bond sell-off does not indicate near-term concern about the sustainability of Germany’s debt – which, at around 63 % of GDP, is far lower than the level in other comparable developed economies. Rather, the rise in yields is largely due to Germany’s decision to turn on the growth engine. Expectations of higher economic growth have propelled the Euro upwards against the US dollar and Swiss franc, and sent a clear message that Europe’s stars are rising.

Positioning

We remain slightly overweight in equities, even though we are concerned about an escalating trade war. Trade wars are bad for the economy and financial markets. Tariffs lead to lower growth and higher prices, the definition of stagflation. The exact impact of the US tariffs, however, will depend on their size and scope. A 20 % rate on Chinese imports seems manageable compared to the 60% once floated. Sustained 25 % tariffs on Canada and Mexico, the two largest trading partners of the US – with all three countries economically heavily intertwined – could clearly harm the economy. If a 25 % tariff on European imports were added, the cocktail could become toxic. The critical questions are, how far will Trump take it, and at what point would he scale back? As Trump keeps a close eye on the stock market, it would probably take a market correction for him to backtrack. In our opinion, there is a Trump put, but the strike level is not clear. Maybe the one-month delay on USMCA-compliant goods from Canada and Mexico suggests that we have come close. Extremely negative sentiment among US investors and souring corporate sentiment could also indicate that we may have reached the strike level already. On the other hand, US Treasury Secretary Bessent pointed at “short-term pain” in the months to come in a recent interview.

The developments in Europe are positive for equities. A ceasefire or peace deal in the Russia-Ukraine war would be supportive for the European economy. With his brash behavior, Trump seems to have ignited a new European spirit epitomized by the rearmament of the European Union and Germany’s plans to unleash fiscal stimulus – measures that were unthinkable not long ago. As a result, we have shifted some equity exposure from the US to Europe, in particular to German mid-caps as they should benefit most.

US technology and data-center related stocks have suffered in recent weeks. DeepSeek’s cheaper AI model is still in the minds of investors. While selective portfolio adjustments make sense, we remain convinced of the long-term prospects of AI.

The US government is moving forward with a strategic bitcoin reserve. With more news expected on this front, strong volatility will likely continue over the coming weeks.

Market sentiment among US investors has become extremely bearish

Source: Bloomberg

The AAII Sentiment Survey asks individual investors on a weekly basis where the market is heading in the next six months. Bearish views have surged while bullish views have plummeted. In the past, such extreme readings often occurred close to a bottom, for example during the bear market of 2022 or during the COVID crash.

Sources: Bloomberg, FT, Goldman Sachs, NZZ, Steno Research, AAII (American Association of Individual Investors)

-

Markets, Volatility & Productivit...Market View February

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 06.03.2025.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.