Market View January

After the Rally: Market Volatility and a Cautious Outlook for 2025

created by Ullrich Fischer, Chief Investment Officer

-

Markets, Volatility & Productivit...Market View February 2026

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

Positive momentum and US exceptionali...Market View December 2024

-

Resilient US growth amid election unc...Market View November 2024

Executive Summary

- S&P 500’s historic rally: The S&P 500 delivered its strongest two-year gain in 2023-2024 since 1998, driven by US exceptionalism and a heavy market concentration in the “Magnificent 7” stocks.

- Wall Street’s optimism for 2025: Analysts anticipate a 12% gain on average for the S&P 500, with earnings growth leading the charge, according to Bloomberg. A slowdown in Big Tech’s momentum could create room for broader market participation, including cyclical stocks.

- Our outlook: While 2025 won’t mark the end of the bull market, we foresee a challenging year, likely featuring a significant correction before a better year-end. We plan to shift to a more neutral stance in Q1 until headwinds and tailwinds become clearer. US tariffs are expected to dampen global growth.

- Positive drivers remain: Earnings growth, productivity gains and favorable liquidity conditions (especially in Q1, due to US debt-ceiling mechanics) will support the market. However, risks such as inflationary pressures could disrupt this momentum in the coming months.

- Key risks and headwinds: Sticky inflation and policy uncertainty under the new US government, along with potential disruptions from the US Federal Reserve (Fed), could present significant challenges. Headline volatility will likely rise until markets adjust to the second Trump administration. Major risks include a global trade war, a potential AI-driven tech sector plunge, a strong US dollar and rising bond yields.

- Secular inflation trends: Emerging signs point to a prolonged period of higher inflation, interrupted by cyclical disinflation as seen in 2023 and 2024. Inflation trends will be pivotal for financial markets in 2025.

- A weaker Fed put: The Fed’s December meeting revealed a less market-friendly stance and lack of clear communication about policy going forward. We believe the Fed’s new reaction function represents a reset rather than a complete hawkish pivot – meaning it could also shift back to support growth in the coming months.

- Europe: No euro area economy has struggled more than Germany, but the February elections could be a turning point.

2024 in Review: key numbers and market highlights

- US stocks dominate: The S&P 500 posted a remarkable +25.0% total return in 2024, outpacing international stocks – such as the MSCI World ex USA Index, at +5.3% in USD – by nearly 20 percentage points. This marks the largest outperformance since 1997.

- Concentration in large caps: The 10 largest stocks in the S&P 500 were responsible for 70% of the index’s return.

- The Magnificent 7: The so-called “Mag 7” stocks surged by +67%, adding a staggering USD 5.2 trillion to their market capitalization.

- Style leadership: US growth stocks outperformed value stocks by 23.5 percentage points (based on S&P indexes), while large caps beat small caps by 13 percentage points (based on the Russell indexes).

- Under-the-radar winners:

- China’s CSI 300 Index quietly delivered a +18% gain, marking its first annual increase since 2020.

- Argentina’s MERVAL index soared +114% in USD, claiming the top spot globally, as it was driven by a booming banking sector and an economic revival. President Milei’s macroeconomic stabilization and credit market reforms are credited for fueling these gains. Analysts suggest this could inspire policy initiatives under the US government’s new Department of Government Efficiency (DOGE) – to be run by Elon Musk and Vivek Ramaswamy – in 2025.

- Dollar strength: The US dollar surged to a two-year high against the euro in 2024, with most currencies declining sharply against it due to widening interest rate differentials. The dollar is now considered the most overvalued in history by Bank of America.

- Bond markets with dismal returns:

- US bonds delivered a mere +1.3% gain in 2024, according to the Bloomberg US Aggregate Bond Index. Over the past five years, US bonds have suffered a -1.8% return, the worst five-year performance on record, with a drawdown lasting 53 months – by far the longest in history. Fixed income has had a poor start in 2025 as well. The 10-year Treasury yield has risen to 4.75%, up more than 20 basis points year-to-date and over 100 basis points since the Fed began cutting interest rates in September 2024. The current rate-cutting cycle so far is the second-worst for 10-year US Treasuries in history.

- Yields are now closely correlated with inflation swaps, a sign of rising inflation concerns among investors.

- US fiscal concerns:

- In 2024, 23% of all US government revenue was allocated to interest payments.

- For the 2025 fiscal year (starting 1 October 2024), this ratio is on track to rise to approximately 30%, exacerbating the already dire fiscal outlook.

The Wall Street Consensus Outlook for 2025

Bloomberg conducted an in-depth analysis of 700 research reports from 50 Wall Street institutions, revealing the following areas of consensus among investors:

- A strong belief in US economic resilience underpins expectations for modest global growth. Confidence remains subdued for significant economic improvements in Europe and China, with the US seen as the dominant engine of growth.

- Inflation is expected to remain contained and range-bound both in the US and globally. However, emerging risks could delay its return to central bank target levels.

- The consensus stance on central bank interest rates is as follows:

- Federal Reserve (Fed) and Bank of England (BOE): continuation of the “higher for longer” regime

- European Central Bank (ECB): the most dovish stance among major central banks

- People’s Bank of China (PBOC): also dovish, supporting growth

- Bank of Japan (BOJ): tightening policy as inflation gains traction

- Tax cuts and deregulation are widely regarded as near certainties, reinforcing pro-growth fiscal measures.

- Tariffs are perceived as a negotiating tool for President Trump – and expected to be targeted rather than sweeping. China will likely bear the brunt of any new tariffs.

- The theme of US exceptionalism extends to market leadership, with growth predicted to expand into small- and mid-cap companies. In terms of artificial intelligence (AI), investors are likely to shift the focus from “picks and shovels” (infrastructure and foundational technology) to productivity-enhancing applications.

- 2025 is seen as a “carry” year for fixed income, meaning returns will primarily come from coupon payments rather than capital appreciation.

- Credit markets are preferred over US Treasuries for income generation.

- Cash is the least favored asset class.

- US dollar: Strong bullish sentiment persists, with some analysts predicting parity with the euro.

- Gold: Sentiment is mixed, with no clear consensus.

- Base metals: These industrial metals are considered attractive within the commodities space.

- Crude oil: Opinions range from neutral to bearish.

- The top three risks identified for 2025 are:

- Global trade war, with a potential escalation triggered by President Trump

- Burst of AI bubble, given concerns about overvaluation and excessive optimism

- Potential resurgence of bond vigilantes as markets respond to excessive government spending

A reminder from Bespoke Investment Group: Wall Street consensus price targets have historically missed the mark by an average of 14% over the past 24 years. This track record suggests a strong possibility that the consensus will again fall short in 2025.

Europe’s Growth Outlook: Modest progress amid challenges and opportunities

Growth in Europe will likely remain uneven and modest overall but should improve, supported by strong wage growth and declining interest rates. Spain and Switzerland are expected to lead with real GDP growth rates exceeding 1%, while Germany, France and Italy may only achieve modest growth, slightly under 1%.

The eurozone continues to lack a unified, widely supported strategy for its long-term economic development, in stark contrast to the clear economic visions observed in China and the United States. Initiatives such as the 2024 Draghi report – which emphasizes strengthening the single market and enhancing investment to bridge Europe’s technological gap with the US and China – have struggled to gain traction. Significant barriers remain, namely the fear of voter backlash against difficult reforms and the challenge of achieving consensus among 27 member states. This is compounded by arguably weak or ineffective leadership in key countries like Germany and France. In this regard, Elon Musk’s involvement in European politics raises particular concern about undue influence on democratic processes and the potential destabilization of foreign policy, as his vast resources and social media reach can amplify partisan agendas.

In addition to monetary and fiscal measures, Europe could greatly benefit from deregulation, a policy approach that has delivered tangible benefits in the US. Complaints about excessive regulatory burdens, however, continue to weigh on the region’s economic prospects. Potential progress in this area may become clearer following Germany’s federal elections in February and plans announced by the new European Commission.

- Germany theoretically has significant fiscal capacity, with Deutsche Bank estimating that raising the debt-to-GDP ratio to US levels could unlock approximately EUR 1.5 trillion in spending power (only in theory, of course). The real issue lies less in the ability to spend and more in the willingness to act, as well as the actual efficiency and productivity of any implemented measures.

Should these challenges be addressed, Europe could present an appealing long-term investment opportunity, particularly given its historically cheap valuations compared to the US. We think Europe also stands to be the major beneficiary if President Trump eases up on his tariff agenda, boosting trade and growth prospects for the region.

For Swiss equities, we see potential for outperformance as they underperformed the Stoxx 600 in the last two years. While they appear promising – with solid earnings growth and room for valuation upside in 2025 – clarity on US policy is needed first. Earnings growth is expected to exceed that of the Stoxx 600 and be driven mainly by insurers and pharmaceutical companies. The latter, however, may face challenges from potential US healthcare reforms under Trump. Swiss stocks are poised to benefit from a defensive composition, a strong thematic tilt, limited exposure to China and substantial dollar exposure, which could act as a favorable foreign exchange (forex) tailwind.

The prospects for peace in Ukraine remain a major uncertainty. Trump has repeatedly claimed he would resolve the conflict within 90 days, and betting markets (Polymarket) currently assign a 31% probability to this outcome. While we are in no position to predict how this tragic situation will be resolved, such optimism seems premature at this moment in time.

In summary, Europe offers potential investment opportunities in 2025, but clear indications of political commitment and economic reform will be needed. Signs of progress in deregulation, fiscal initiatives and conflict resolution would significantly enhance the region’s attractiveness.

Navigating 2025: Balancing caution and opportunity during policy shifts and uncertainty

The critical question now facing investors is whether the recent equity market volatility reflects simple profit-taking and portfolio rebalancing after a strong 2024 or a deeper reassessment of risk appetite. The prospect of a less dovish Fed, heightened policy uncertainty and a less predictable global landscape add a layer of complexity to this analysis.

Fed Governor Christopher Waller summarized the challenge on 8 January 2025: “Until Trump policies are clear, it will be hard for markets and the Fed to assess the next year.”

Our view leans toward maintaining confidence in the bull market while preparing for increased volatility. We are looking at a gradual reduction in equity exposure during Q1, as liquidity dynamics remain favorable in the short term. The reactivation of the US debt ceiling on the first day of the year set the stage for a notable Treasury General Account (TGA) drawdown, estimated at USD 650 billion, beginning mid-January. This temporary injection of liquidity into the banking system may revive risk assets.

- With the debt ceiling reinstated, the US Treasury is effectively unable to increase public debt in the coming weeks on a net basis – at least until a potential agreement is reached. For now, that seems uncertain as the Democrats will likely use the debt ceiling as leverage to push parts of their agenda. As a consequence, the TGA, which is the US Treasury’s cash reserve held at the Fed and outside the banking system, will need to act as the primary funding source until a new suspension of the debt ceiling is negotiated.

The additional liquidity could also bring a reversal in both the US dollar and bond yields, which seem due for at least a pause after their massive runs. This would further support risk sentiment early in the year.

However, the backdrop remains complex. The debt-ceiling standoff has created a sense of uncertainty about fiscal policy. Meanwhile, the Fed’s hawkish reset in December diminished the Fed put that had previously underpinned equity markets. Fed Chair Jerome Powell’s recent struggle to clearly communicate future policy has widened the range of potential outcomes. Markets now face the challenge of pricing in this broader distribution of possibilities amid political and economic unpredictability, including the erratic actions (which will not be listed here) by the incoming US president.

Despite these headwinds, we do not foresee a bear market, given the ongoing positive earnings cycle. However, a correction of approximately 15% – deeper than the max drawdown (-9%) seen in 2024 and closer to the historical annual average of 14% – is our base case for 2025.

While we are satisfied with how we handled the bullish set-up for 2024, staying overweight on equities and adding additional risk at opportune times, we are admittedly surprised by the volatile and weak end of 2024. December’s performance underscored emerging risks, as the S&P 500 suffered its largest drop from Christmas to year-end since 1952. Weakening breadth since mid-November, coupled with the Fed’s hawkish shift on 18 December, are sending a clear warning signal.

The new economic environment reflects a shift in policy dynamics. The Fed has moved from an asymmetric focus on labor market stability to a more balanced approach that again emphasizes inflation control. As inflation is unlikely to return to and stay at 2% without a recession, policy rates may remain elevated for longer and create a headwind for richly valued stocks. At the same time, political volatility and fiscal policy sequencing – such as potential tariff-driven supply shocks or immigration crackdowns preceding the benefits of tax cuts and deregulation – pose additional risks.

Nevertheless, there are positives for the markets. Private sector balance sheets remain strong, with households and corporations in robust financial positions. The AI-driven infrastructure boom continues, fueled by onshoring trends, deregulation and legislative initiatives like the Inflation Reduction Act (“The ChatGPT moment for robotics is coming…” – Jensen Huang, founder and CEO of NVIDIA, 6 January 2025). Overbought market conditions from November have corrected, and the unexpected hawkish Fed change creates room for a dovish shift if inflation eases or the labor market weakens. Our sense is that we are also back in the upside-down macro world with a “bad is good” dynamic, where weaker economic data supports markets by reducing yields and the US dollar.

In this environment, we expect markets to fluctuate between inflation scares, soft-landing hopes and growth concerns. A soft landing ultimately remains our base case, assuming the Fed avoids a significant policy misstep or is not politically forced into one.

US real GDP growth is likely to slow to slightly above 2%, but this deceleration should eventually help to stabilize bond market volatility and bring yields lower. Inflation, however, is expected to surprise to the upside throughout the year, keeping the Fed cautious.

Internationally, China remains a wildcard. Decisive stimulus has been absent in the face of demographic challenges, property market struggles and debt deflation. While direct-to-consumer fiscal measures (also known as helicopter money) could shift the narrative, geopolitical tensions, especially with US tariff policies, do complicate the outlook.

In summary, while the bull market remains intact, its drivers have weakened. Elevated volatility, tighter liquidity conditions down the line and a broader range of risks suggest a more cautious approach this year. Markets are currently repricing risk assets in response to rising bond yields, a strong US dollar, December’s new Fed stance and uncertainty surrounding Trump’s rhetoric and tariff policies. Many assets are in a no-man’s-land, undergoing a sideways correction that we believe reflects the broader trend likely to define 2025.

Positioning

To navigate the opportunities and risks of the year, we will be taking a balanced and flexible approach, prioritizing quality and adaptability. Maintaining a moderate risk profile, we will stay focused, has we have been, on optimizing full-cycle risk-adjusted returns while minimizing sharp drawdowns and mitigating volatility drag. Disciplined risk management will remain a cornerstone of our strategy.

Our approach to constructing portfolios

- Emphasis on diversification, liquidity and high-quality risk assets

- Avoidance of strategies relying heavily on leverage for return generation

- Preference for large-cap, quality companies with strong credit ratings, solid balance sheets and resilient business models

- Gold as the primary portfolio diversifier, given the huge increase in money supply, surge in sovereign deficits, upside risks to inflation and geopolitical uncertainty as well as dwindling central bank credibility and rising populism

- Incorporation of select alternative investment strategies from top-tier managers to enhance risk-adjusted returns and create positive asymmetry in the portfolio’s return profile

Key observations and tactical positioning

- The only assets currently displaying really attractive set-ups are certain commodities (e.g. base metals) and gold.

- The USD and bond yields are both in overbought territory but could overshoot further. A reversal could spark a rally in risk assets, which we would probably use to further reduce our equity allocation.

- The outlook for stocks appears increasingly challenging, with headwinds from persistent inflation, a growing bond supply and potential tariff-related pressures. While we do not foresee a sharp “melt-up” in bond yields, we acknowledge the likelihood of yields stabilizing at higher levels. In our view, the longer yields remain elevated, the greater the risk of an equity market correction.

- We still think that a 4.00%-4.50% for the US 10-year yield is optimal for supporting equity multiples. If economic strength and earnings growth persist, yields up to 4.75% may also prove manageable for equities. Higher levels would likely challenge equity valuations.

- We expect the Fed to be the first to pause the easing cycle and expect only one rate cut in the first half, as long as the labor market slowdown remains moderate. The Fed funds rate is expected to remain at least 100 to 200 basis points above the policy rates of its peer central banks over the next few quarters.

- A Fed pause, followed by the required refill of the TGA account (likely in Q2), will probably mark the end of easy financial conditions for several months. This is why we see a higher probability of an equity correction in this period.

- We remain overweight US equities for now, given the economy’s robust momentum. President Trump’s focus on igniting an economic boom could further energize growth in the second half of the year, provided fiscal measures and tariffs don’t trigger excessive inflationary pressures.

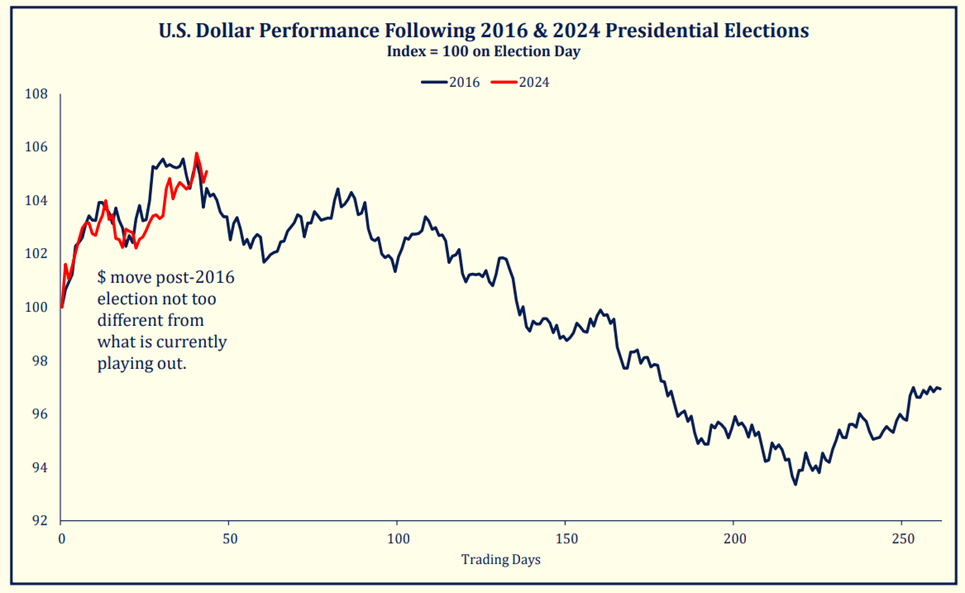

The path of the US Dollar will be critical for broad markets in 2025

Source: Strategas

The strong US dollar is being driven by a combination of factors, including growth and interest rate differentials favoring the US, heightened rate volatility, policy uncertainty, and tariff risks. If the dollar peaks or stabilizes at its current levels, we foresee the potential for a rally in risk assets. At present, the dollar appears significantly overbought, creating a substantial challenge for financial conditions at these elevated levels. Notably, its recent behavior mirrors the pattern seen during Trump’s first presidency, where the dollar rallied leading up to the inauguration and then declined. Similarly, we expect the White House to eventually adopt rhetoric aimed at weakening the dollar.

Sources: Bloomberg, Morgan Stanley, Bank of America, Goldman Sachs, The Macro Compass, The Market Ear, Steno Research, 42Macro, JPM, Hightower Naples, Strategas, FT, LBBW, BCA Research

-

Markets, Volatility & Productivit...Market View February

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

Positive momentum and US exceptionali...Market View December

-

Resilient US growth amid election unc...Market View November

Disclaimer

This Publication was created on 09.01.2025.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.