Market View November

Resilient US growth amid election uncertainty, and glimmer of hope in Europe

created by Maximilian Mantler, Deputy Chief Investment Officer

-

Goldilocks First, Overheating Later —...Market View January 2026

-

Dovish Fed Pivot, Labor Softening &am...Market View December 2025

-

The AI Supercycle, Fed Easing & a...Market View November 2025

-

Skepticism Fuels the Bull: Under-Owne...Market View October 2025

-

AI Momentum, Fed Shift, Inflation WatchMarket View September 2025

-

Rally Faces Headwinds: Markets Remain...Market View August 2025

-

The return of Goldilocks is taking shapeMarket View July 2025

-

Resilient stock markets have more roo...Market View June 2025

-

Markets Recover Despite Fragile Senti...Market View May 2025

-

US Tariffs and Their Impact: Risks fo...Market View April 2025

-

Market Upheaval: US Protectionism and...Market View March 2025

-

Markets on the move: Volatility, AI c...Market View February 2025

-

After the Rally: Market Volatility an...Market View January 2025

-

Positive momentum and US exceptionali...Market View December 2024

Executive Summary

- Strong economic growth continues, substantiating the argument for a “no landing” scenario rather than a soft or hard landing. In the US, GDP grew by an annualized rate of 2.8% in Q3. In the Eurozone, growth accelerated to 1.6%, with Spain acting as the growth engine and Germany dodging a recession, though its manufacturing sector continues to struggle.

- The US presidential election is November’s main event. A Trump victory would probably boost US stocks in the near term. However, his stance on tariffs and immigration are inflationary and could put the US Federal Reserve (Fed) off its interest-rate cutting cycle. We expect that a Harris victory would mean more of the same: steady growth in US stocks and relief in global equities due to a moderate approach to tariffs. It seems neither candidate has plans to reduce the government deficit of around 6% of GDP, raising concerns over fiscal sustainability and inflation.

- We are still bullish about the coming months given the resilient economic growth, solid corporate profits and increasing financial liquidity − as well as inflation that is under control and a Fed focused on supporting the labor market.

- Gold has rallied significantly, driven by ETF inflows. While a setback should be expected, we believe it is nothing to be worried about.

- Bitcoin is nearing a breakout and end of its consolidation phase, which could lead to significant gains.

Monthly Review Robust US stocks and surging gold

- The S&P 500 reached another all-time high in October before pairing gains in the days before the US election. Still, the index is on track to record the best performance in a US presidential election year in almost a century. Usually, the stock market struggles ahead of US elections.

- Against expectation, long-duration yields have risen instead of fallen following the Fed’s first rate cut of 50 basis points in September. The yield on 10-year US government bonds has increased from 3.60% to 4.30% while the rate of 30-year US mortgages has climbed from 6.60% to 7.20%. The rise in yields has also occurred in Europe, although to a lesser extent. We can attribute this to the better-than-expected economic data as well as growing concerns about government deficits and the potential return of inflation.

- Propelled by returning investment flows from the West, gold has ferociously rallied higher and currently trades at about USD 2,700 per ounce. In our September Market View, we explained why ETF inflows would drive gold even higher and have been right with this assessment so far.

- Bitcoin is on the cusp of breaking out of a consolidation phase that began in March.

Market Development

The US economy expanded at a robust pace in the third quarter. Real GDP increased at a 2.8% annualized rate after rising 3% in the previous quarter. Consumer spending, which comprises the largest share of economic activity, advanced 3.7%, the most since early 2023. The acceleration was led by broad increases across goods. This marks the sixth quarter of consecutive growth above 2.5%, and the longest stretch of such growth since 2006.

Given the continued economic expansion, we could argue that we are not heading towards a soft landing but rather a no landing scenario. Since the short-lived growth scare in August, good news has been good news for equities, and we expect this environment to continue as long as the Fed remains focused on the labor market, which it likely will for several more months.

Europe

Economic growth in the Eurozone expanded more strongly than expected in Q3. Growth quickened to an annualized rate of 1.6%, up from 0.8% in Q2. Spain drove the growth with 3.2%. Germany even avoided the recession it was widely tipped to endure, growing by 0.8% on an annualized basis. At the same time, Germany’s manufacturing sector is still grappling with a loss of competitiveness that executives blame on high energy costs, excessive regulation and shortages of skilled staff. The latest woes at Volkswagen are emblematic for the country’s economic situation on the whole.

Switzerland

The Swiss National Bank might need to cut interest rates again as inflation slows, according to new president Martin Schlegel. The central bank’s focus will be on normalizing monetary policy and ensuring that it does not become too restrictive. Inflation is below 1% and worries are growing that it could undershoot the target range of 0% to 2% in the course of next year. With policy rates at 1%, the space to ease seems limited, which is why Schlegel does not rule out a return to negative interest rates.

How would financial markets react to Harris or Trump?

The US elections take place today. According to polls, the two presidential candidates are neck in neck, while betting markets indicate higher odds for a Trump win. Within the financial community, Trump’s chances are being rated higher, too. In any case, we think it makes sense to be prepared for either outcome and consider the possible consequences for financial markets.

Under Trump, we believe that financial markets are likely to heat up. His administration’s anticipated fiscal expansion and deregulatory approach would likely fuel robust economic activity, buoying US equities. Banks and other financial services companies could benefit in particular. This scenario also suggests US economic and stock market outperformance relative to global peers. However, Trump’s stance on tariffs and immigration would increase inflationary pressures. Additional tariffs would lead to higher prices of goods. Reducing immigration would also tighten the labor market and lead to higher wages. As a result, the Fed would cut interest rates fewer times than currently expected, leading to a rise in the term premium for long-duration bonds. These effects would be amplified in the case of a red sweep, where the Republicans control both the Senate and House of Representatives. Prediction markets point to a 40-50% probability of a red sweep.

A critical risk under a Trump-led presidency is the potential to start a trade war by raising tariffs before passing tax cuts. The president has the authority to quickly impose tariffs through executive powers but needs congressional approval to enact tax cuts, which could take months to achieve. In the event of a global trade war, the US dollar could reach parity against the euro. Without that, we expect a strong US dollar in the range of 1.05 to 1.10.

A Harris victory, we believe, would represent a more stable, status quo environment. The Fed would probably reduce interest rates as guided. The US dollar could weaken moderately, reflecting a balanced economic environment with a lower tariff risk. We would expect steady, though not exuberant, growth in US equities. Since a Harris administration would likely take a moderate approach to tariffs and adopt a more internationalist stance, global equities would be relieved.

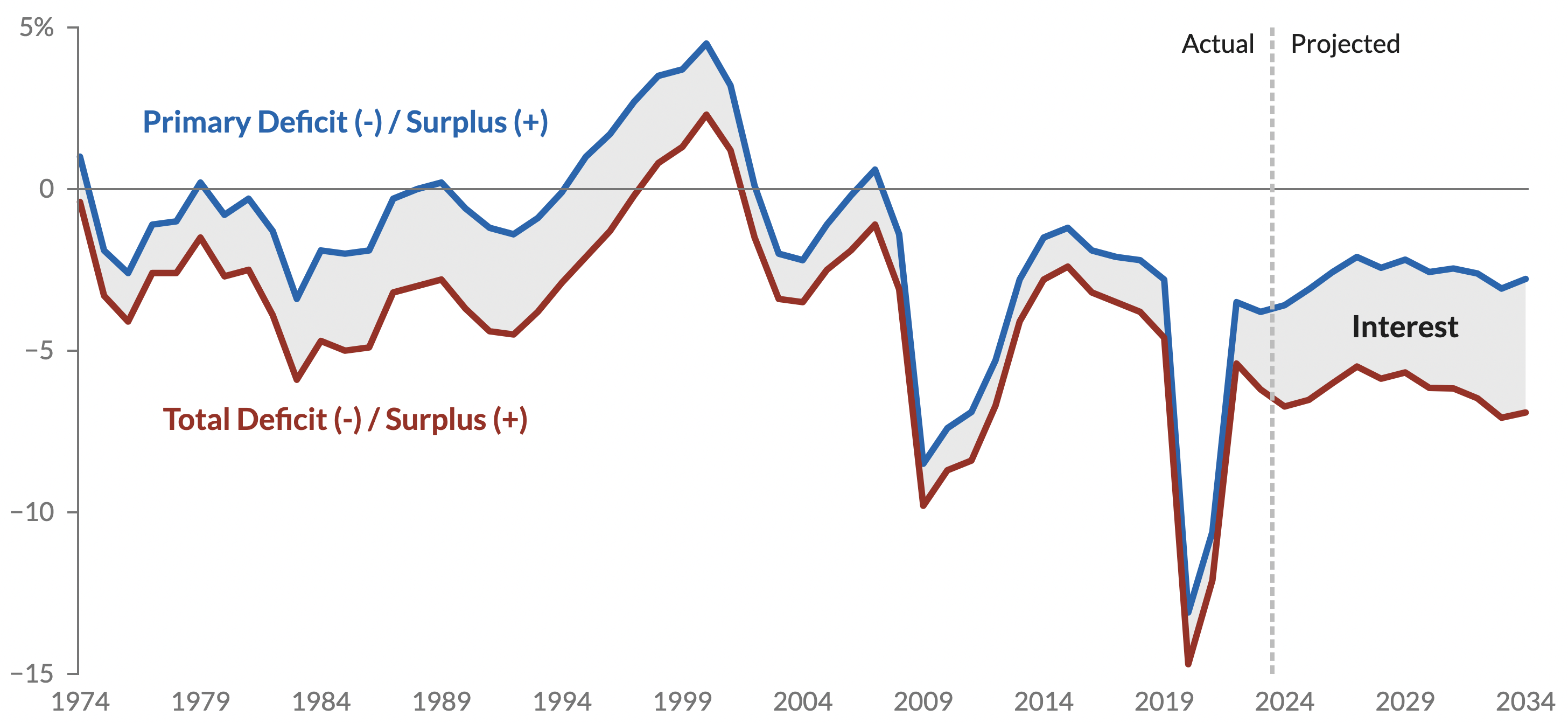

Regardless of the election outcome, the record US debt level and large deficit make long-duration bonds rather unattractive. Total public debt stands at approximately USD 36 trillion or 120% of GDP, and the deficit is running at around 6%. The US has in fact been running a primary deficit since 2008, meaning that revenues are smaller than non-interest expenditures. Compounding this issue is the fact that since the normalization of monetary policy, the debt burden has significantly increased and is expected to continue. It is anticipated that 23% of government revenue in 2024 will be devoted to interest payments and could reach 30% in 2024. Neither candidate has put forward a plan to address the debt situation – and both candidates are likely to increase the debt and deficits even more. According to an analysis conducted by the Committee for a Responsible Federal Budget, Trump’s campaign plans would increase the debt by an additional USD 8 trillion until 2035, while Harris’s plans would add USD 4 trillion. The estimates come with a wide range of uncertainty, reaching up to USD 15 trillion for Trump and USD 8 trillion for Harris.

Positioning

Despite the growing, longer-term concerns about fiscal sustainability and inflation, we expect most of the current bull market conditions to hold through the end of Q1 in 2025. Economic growth is proving resilient, in addition to solid corporate profits and increasing financial liquidity. Inflation is also under control while the Fed is focused on supporting the labor market.

For now, the US economy potentially running hot is positive for the stock market. Gold, bitcoin, commodities and the US dollar also benefit. The environment is negative for bonds, however, which is why we will keep our clear underweight position in this asset class.

We have made no significant changes to our portfolios in the run-up to the US elections, remaining positioned at the upper limit of our tactical equity range. We would consider adding risk in a correction caused by the US presidential election, as such a correction would probably be brief and not change our constructive outlook for the months ahead.

Our main investment choices continue to be quality-growth stocks and gold. In this context, investor positioning in mega-cap growth and tech stocks has moderated markedly over the last weeks and months. As for gold, we would not be surprised by a consolidation or setback after this sharp rally. For the long term, however, our conviction in gold is unaffected. Bitcoin is close to breaking out of a seven month-long consolidation phase. A push above the previous all-time high from March 2024 would open the door for substantial further gains. In our opinion, Bitcoin offers a similar level of protection against monetary debasement as gold. It exhibits higher volatility, but the returns are potentially higher. While Bitcoin tends to appeal to a different demographic group – mainly younger, tech-savvy investors – institutional adoption is underway. As a result, we think that it makes sense to have some exposure to Bitcoin in a multi-asset portfolio.

Interest payments will be a significant contributor to deficits

Many economists point out that when the primary deficit is small and interest rates are lower than the growth rate of nominal GDP, the debt-to-GDP ratio falls. However, with the primary deficit projected to average 2.1 percent of GDP over the next decade − and with interest rates at relatively high levels − debt will continue growing faster than the economy.

Sources: Bloomberg, Goldman Sachs, WSJ, Financial Times, Committee for a Responsible Federal Budget, Federal Reserve Bank of St. Louis, Peter G. Peterson Foundation

-

Goldilocks First, Overheating Later —...Market View January

-

Dovish Fed Pivot, Labor Softening &am...Market View December

-

The AI Supercycle, Fed Easing & a...Market View November

-

Skepticism Fuels the Bull: Under-Owne...Market View October

-

AI Momentum, Fed Shift, Inflation WatchMarket View September

-

Rally Faces Headwinds: Markets Remain...Market View August

-

The return of Goldilocks is taking shapeMarket View July

-

Resilient stock markets have more roo...Market View June

-

Markets Recover Despite Fragile Senti...Market View May

-

US Tariffs and Their Impact: Risks fo...Market View April

-

Market Upheaval: US Protectionism and...Market View March

-

Markets on the move: Volatility, AI c...Market View February

-

After the Rally: Market Volatility an...Market View January

-

Positive momentum and US exceptionali...Market View December

Disclaimer

This Publication was created on 26.11.2024.

The information contained in this document constitutes a marketing communication from FINAD (FINAD AG, Zurich; FINAD GmbH, Vienna or FINAD GmbH, Hamburg branch). This marketing communication has not been prepared in accordance with legislation promoting the independence of investment research and is not subject to any prohibition on trading following the dissemination of investment research. This document is for general information purposes only and for the personal use of the recipient of this document (hereafter referred to as “recipient”). It does not constitute a binding offer or invitation by or on behalf of FINAD to purchase, subscribe, sell or return any investment or to invest in any particular trading strategy or to engage in any other transaction in any jurisdiction. It does not constitute a recommendation by FINAD in legal, accounting or tax matters or a representation by FINAD as to the suitability or appropriateness of any particular investment strategy, transaction or investment for any individual recipient. A reference to past performance should not be construed as an indication of the future. The information and analyses contained in this publication have been compiled from sources believed to be reliable and credible. However, FINAD makes no warranty as to their reliability or completeness and disclaims any liability for losses arising from the use of this information. All opinions and views represent estimations that were valid at the time of going to press; we reserve the right to make changes at any time without obligation to update or communicate them. Before making any investment, transaction or other financial decision, recipients should clarify the suitability of such investment, transaction or other business for their particular circumstances and independently (with their professional advisors if necessary) consider the specific risks and the legal, regulatory, credit, tax and accounting consequences. It is the responsibility of the respective recipient to verify that he/she is entitled under the law applicable in his/her country of residence and/or nationality to request, receive and use this publication for personal purposes. FINAD declines any liability in this respect. An investment in the funds and other financial instruments mentioned in this document should only be made after careful reading and examination of the latest sales prospectus, the fund regulations and the legal information contained therein and after prior consultation with your client advisor and – if necessary – your own legal and/or tax advisor. It is the responsibility of the respective recipient to check whether he is entitled to request and receive the relevant fund documents under the law applicable in his country of residence and/or nationality. Neither this document nor copies thereof may be sent to or taken into the United States or distributed in the United States or handed over to US persons.

This document may not be reproduced in part or in full without the prior written consent of FINAD.

For Switzerland: FINAD AG, Talstrasse 58, 8001 Zurich, Switzerland is a public limited company specialized in financial services and asset management, established under Swiss law. FINAD is authorised as asset manager by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the Supervisory Organization (SO) AOOS. FINAD is also associated with OFS Ombud Finance Switzerland (http://www.ombudfinance.ch). Complaints about FINAD can be addressed to SO AOOS or OFS.

For Austria: FINAD GmbH, Dorotheergasse 6-8/L021, 1010 Vienna, Austria is an investment firm according to Section 3 of the Austrian Securities Supervision Act 2018 (WAG 2018) and as such is entitled to provide investment services of investment advice, portfolio management as well as the acceptance and transmission of orders, in each case with regard to financial instruments. FINAD is not authorized to provide services that involve holding clients’ money, securities or other instruments. FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna (www.fma.gv.at). Complaints about FINAD may be submitted to the FMA.

For Germany: FINAD GmbH Deutschland, Schauenburgerstraße 61, 20095 Hamburg, Germany is the German branch of FINAD GmbH, Dorotheergasse 6-8/L/021, AT-1010 Vienna, Austria. FINAD is an independent securities services company specialized in investment advice, investment brokerage and asset management (financial portfolio management). The provision of securities services by FINAD is subject to the supervision of the Financial Market Authority (FMA), Otto-Wagner-Platz 5, 1090 Vienna, Austria (www.fma.gv.at) as well as the Federal Financial Supervisory Authority (BaFin), Graurheindorfer Straße 108, 53117 Bonn, Germany and Marie-Curie-Straße 24-28, 60439 Frankfurt am Main, Germany (www.bafin.de). Complaints about FINAD can be addressed to the FMA or BaFin.

FINAD is not authorized to practice law, provide tax advice or auditing services.

© Copyright FINAD – all rights reserved.

For more details about the company, please visit https://finad.com/en/imprint.